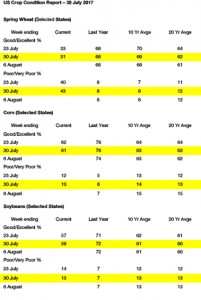

- US crop conditions have been updated as follows:

- Today has been described as “a bloodbath” in Chicago as soybean markets posted sizeable losses with the Nov ’17 contract falling below its 200 day moving average ($9.85) with corn and wheat markets following in harmony. The rise in weekly soybean crop condition (see above) together with the prospect of “normal” Midwest rainfall beyond 10 August, was sufficient to spark fund selling and position liquidation. $9.63/bu is the next downside target (Nov ’17 soybeans) at an open chart gap. Dec ’17 corn is toying with an uptrend line $3.76/bu whilst wheat support is noted at or just below $4.70, and this is currently breached.

- Macroeconomic factors contributed to the morning Chicago selling including a sharp fall in crude oil and a comment from former US Fed Chairman Greenspan that the bubble is not in the equity markets, but in the bond markets. Greenspan mentioned that rising inflationary pressures are possible if the US$ continued to decline.

- The Indian Monsoon is sputtering and concern is emerging about reduced oilseed/cotton and sugar production in 2017. The Indian monsoon has produced well below normal rainfall for the past 30 days and crop stress is said to be building. India is the world’s largest importer and if the monsoon does not return to strength by August 10th, yield damage will be unavoidable. Indian weather will need to be monitored more closely going forward.

- The Canadian Prairies forecast remains arid for the next two weeks and wheat and canola crop estimates will continue to decline. If rain arrives during the last half August, some benefit will be seen, but the calendar is running out for Mother Nature to be of much assistance. We see the Canadian wheat crop at below 24 million mt, down 4 million from the WASDE forecast in July.

- Yield data is raising Russian wheat crop estimates with some private forecasts placing the crop as large as 76-77 million mt. However, Russia has logistical constraints and they will struggle to be able to export more than 29-30 million mt amid this year’s slow start. Russia will therefore likely become a wheat storehouse in 2018.

- To conclude, it is too late to become bearish of corn, soybeans or wheat with the rain in the forecast, but (crucially) not yet in the rain gauge. The USDA August report looms next week on Thursday. The downside price targets are; $9.55-9.65 in Nov soybeans, $3.70-3.75 in Dec corn with wheat already at value. There may be a little more selling to work through, but the downside is limited.