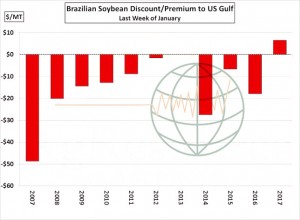

- Brazil is on track to harvest a potentially record soybean crop, and export commitments so far in January are higher than expectations. The global cash market, however, is not yet providing incentive for a wholesale switch to S America. The graphic below shows Brazilian soybean’s discount to US Gulf, or in the case of this year, Brazil’s premium to US Gulf. Weaker basis is therefore likely to be forthcoming, but in the meantime we would expect solid US soybean sales and shipments through the month of February.

- Chicago markets started trading weaker but quickly rallied into positive territory on the back of fund buying and rumours of fresh Chinese demand. Some Chinese traders are returning from their New Year break and have positions to cover it seems. There is also something of a traditional post New Year seasonal bullishness. It is noteworthy that cash soybean meal is weakening and this is acting as a drag upon futures prices. Finally, there is the issue of fresh Russian/Ukraine military clashes in E Ukraine, which will doubtless put some further strain on the Trump administration. Support for Ukraine will likely come from a financial or trade perspective and global grain traders are watching this closely.

- S American farmers are noting that the Brazilian Real has rallied and that Chicago prices have fallen this week and consequently are not cash related sellers. The lack of cash selling allows for market corrections, but most S American sources argue that it would require new highs for any large scale Brazilian farmer selling. Our bet is farmers will now wait for yield results before selling much in the way of additional cash soybeans.

- This remains a “big crop” vs. “big demand” marketplace and chasing breaks or rallies is still not our recommendation. Corn and wheat are in position to test their recent highs while the weakness in cash soybean meal markets argue that rallies in soybeans will fail. The grains should gain on soybeans, and also soybean oil on soybean meal. Our view remains one of selling strong rallies near their recent highs in the grains.