- Today’s WASDE report was viewed as slightly bearish, and the market has agreed, with US corn, wheat and soybean end stocks all raised by more than was anticipated. In addition, Chinese corn stocks were raided, substantially, and it now leaves the weather to turn adverse for any meaningful rally to develop.

- US corn yield was increased by 1.3 bushels/acre to 169.2 with production up 99 million bu from last month. Yield improvements of 3 bushels/acre plus were seen in IA, MN, NE and ND, which more than offset declines of 1-2 bushels/acre in IL, OH and TN. US corn exports were reduced 50 million bu (as we have been suggesting) whilst ethanol usage was also reduced. The combined impact is an increase in end stocks of 200 million bu month on month. From a feed grain perspective it should also be noted that sorghum stocks were raised 16 million bu and barley stocks were up by 1 million bu.

- Soybean yield was also raised 1.1 bushels/acre, to 48.3 (a new record) with significant month on month increases noted in IL, IA, KY, MI, MN, TN and WI. Soybean consumption was increased in the face of growing supply and also the recent pace of shipments. Crush grew 10 million and exports 40 million, yet supply has grown more than can be consumed and US end stocks are up 40 million bu from October at 465 million bu.

- That really accounts for the report highlights, despite less than ideal summer weather we have corn and soybean yields near or above record levels, presumably due to a combination of improved varieties, technology and crop management.

- US wheat exports were (at last) reduced by 50 million bu to reflect current export pace as well as slower global trade trends and US domestic consumption was left unchanged leaving end stocks up by 50 million at 911 million bu.

- From a global perspective, Chinese 2014/15 corn stocks were revised higher by 19 million mt whilst new crop feed was reduced leaving Chinese end stocks a massive 24 million mt higher than October’s figure.

- World wheat stocks were lowered 1 million mt to 227.3 (still a record) with global production unchanged and domestic use up a million. Major exporters balance sheets were largely unchanged although the EU’s exports were boosted slightly (33.5 million from October’s 33 million) despite current export pace lagging somewhat, whilst EU end stocks were pegged at 16 million mt (up a million), the largest since 2009. It feels as if the USDA still has work to do in fine tuning and adjusting some of its global wheat trade figures and appears to be overstating global consumption somewhat.

- Chinese soybean imports were increased to 80.5 million mt from 79 million, which is in line with Oct/Nov import pace, and this higher use has triggered a decline in global end stocks of some 2.3 million mt to 82.9 vs. 77.6 in 2014/15.

- Doubtless the report is short-term bearish and markets are moving closer to season lows, will they test and break out to the downside? Whilst we would be pleased to see this happen (and justify our long-held bearish outlook) it feels as if this is a tall order despite the fundamental picture supporting this scenario. We advise caution and do not encourage an overly bearish stance.

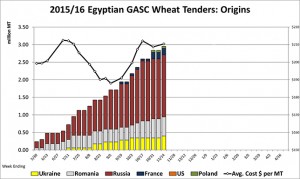

- In other news Egypt’s GASC has secured a further 115,000 mt of wheat in its latest tender, which was for 11-20 Dec shipment. Russia secured 60,000 mt with Ukraine picking up the balance at an average price of $210.41 basis C&F, which is about $2.00/mt above the last tender ten days ago. There were plentiful offers of French wheat but, once again, they were more expensive when freight costs were included and France received the cold shoulder from Egypt – again.

- Our USDA recap can be downloaded by clicking on the link below: