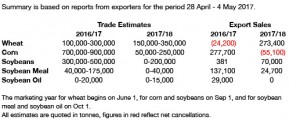

- US export data has been released as follows:

- Stratégie Grains have reported UK crop condition to be suffering as a consequence of dry conditions as rainfall has been below average again this month. Stress was reported to be evident on areas with light soils, and crops on such land exhibiting signs of stress. Dry conditions have left crops struggling to uptake nitrogen, which has the potential to limit output. A further two weeks of dry conditions have been suggested to significantly impact barley yields .

- Chicago markets have seen soybeans and corn trade lower whilst wheat has seen price gains. Improved C Midwest weather prospects have led to weaker row crop prices as improved conditions (warm and dry) would assist some of the worst hit wet and flooded regions, particularly better draining regions. Will the weather window last long enough to see significant planting progress or reseeding is the key debate right now. By Sunday it is estimated that 64-68% of US corn and 26-29% of soybeans will be planted, both figures are only slightly behind the five year averages.It is replanting that really needs monitoring, both the area and the timing are important.

- Corn and soybeans have the potential to ease back price wise as we do not really have a real weather event at this time. It is second half May and later when wet conditions have the potential to impact output. USDA/WASDE new crop demand estimates do not historically change very much from May into August unless there is big drop in the US crop due to drought. Consequently, we can all debate the correctness of US corn, soybean and wheat export estimates for 2017/18, but WASDE tends to move slowly on making adjustment until after the August Crop report (when NASS gets involved on US corn and soybean crops). Thus, it will not take much of a yeild decline to reduce 2017/18 US major grain end stocks and add some spice to Chicago valuations.

- The recent cold weather across N and W Europe appears to have caused yield loss to the winter crops of wheat and rapeseed. Like W Kansas, it will take some weeks to accurately assess the losses, but temperatures were well below freezing in much of Poland, Germany and portions of N Ukraine in recent days. The UK and France are still sufferig from drought as mentioned earlier with the forecast offering additional dry weather beyond the weekend. EU winter grain crop output appears to be in decline, the question is trying to gauge the amount at this early date.