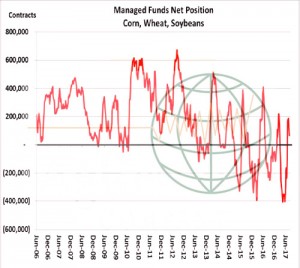

- It seems that the funds have started their exodus from ag based futures on the back of disappointing market performance and this week’s bearish USDA August report. To last Tuesday, which is the effective data point for the CFTC report, the funds are net long 12,913 soybeans and 67,073 corn, and net short 14,101 wheat. Estimates to the current time frame are always difficult but we estimate funds to be short soybeans 11,000, short wheat 21,000 and flat in corn; whether we are correct or not will never be truly proven!

- Soybeans tested Thursday’s lows overnight, and closed with modest gains on Friday. Many analysts and traders were skeptical of the yield increase given condition ratings, while the weather models hold limited rains and building heat in the extended forecast. The market is well aware of the impact that poor late season rains can have on the crop, and will continue to follow weather and crop ratings closely. Good/excellent ratings are expected to be unchanged or 1% lower on Monday, due to the expansion of dryness, but there are large parts of IA, IL, and now the E Cornbelt that are short to very short of soil moisture.

- Corn futures rallied 3-4 cents as the market is highly skeptical of NASS’s first pass at the 2017 US corn yield. There is little doubt that corn yield will be lowered in September and the debate will be one of degree. There is still more than ample evidence to suggest national yield will be at/below 165 bushels/acre, but we all now wait field/harvest data. Note, too, that the heart of the Corn Belt will be without meaningful rain for another 6-7 days. Crop conditions will consequently likely decline. Moving forward, S American basis and crop conditions will drive price determination, and so far Dec has held major chart-based support at $3.70. We caution against turning overly bullish or bearish right now.

- Chicago wheat futures settled marginally lower, while contracts in KC and Minneapolis fell 7-30 cents on continued fund liquidation. Funds’ net long has hung over the market in recent weeks, and in KC and Minn, funds are still net long. Managed funds in Chicago, however, are net short 12,000 contracts, which will act to slow the recent correction. Interior Russian prices have fallen sharply across the Volga Region but, interestingly, have been steady to higher in S Russia, in spite of a record crop. Note that a majority of winter wheat is produced in S Russia, and a majority of exports originate there. So far, cash markets in Russia have followed normal seasonal trends, which suggest a lasting bottom is imminent. Gulf HRW is currently the world’s cheapest quality origin, and its discount to wheat in the Black Sea and Europe continues to widen. It has been a rather steep correction, but seasonal weakness appears close to ending.

- Our weekly fund position charts can be downloaded by clicking on the link below: