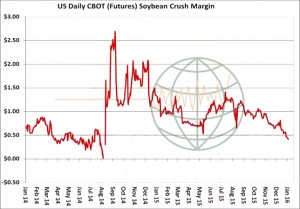

- US soybean crush margins have steadily declined since August, and when one considers that cash soybean meal is being traded at values well below Chicago, the margins for US soybean processors is dismal, and unlikely to improve anytime soon. We would expect that an oversupply of cash soybean meal will ultimately weight on Chicago soybean meal futures and produce lower lows in futures in coming months. This year’s crush margins are very different from last year – limiting demand for beans.

- Brazil’s CONAB updated their 2015/16 crop estimates with corn 300,000 mt higher at 82.3 million mt (split 27.76 million mt for the first crop and 54.56 million mt for the safrinha crop). Soybeans were estimated 102.1 million mt, down 400,000 million mt month on month and wheat was 100,000 mt lower at 5.5 million mt.

- Today’s January USDA WASDE report offered something of a reprieve for the bulls and the big question now is, “Will it last?”. Both 2015 US corn and soybean yields were reduced and soybean harvested acres were trimmed back too. Winter wheat seeding fell below the average of trade expectations at 36.6 million acres, down some 2.72 million acres from last year. We would expect to see midwest farmers plant more soybeans, sorghum and corn in place of winter wheat, which may come through in future reports.

- In the face of favourable S American weather if still feels as if the report is unlikely to change the longer term market direction, but a fund short covering bounce looks likely. The approach of the S American harvest and lacklustre global demand continues to look a formidable longer term obstacle to significant and lasting price increases.

- It remains true that the funds are big shorts and the January report was supportive. However, cuts of 53 million bu of 2015 US corn production, 51 million bu of 2015 US soybean production and a lower US winter wheat seeding total does not alter prevailing bearish price trends. Once the fund short covering runs its course, the market will understand that Argentina and Brazil are aggressive in offering corn, wheat and soybeans for export, and that WASDE has yet to fully reduce US corn, soybean and wheat export estimates enough. Moreover, we believe that the USDA is still way too high with its 2015/16 US soybean crush estimate. Unfortunately, the January report does not build demand in a more worrisome macroeconomic world. Allow the rally to run its course would be our view at this time.

To download our USDA Report recap as a pdf file please click on the link below: