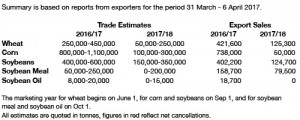

- US weekly export data has been released as follows:

- US soybean and wheat exports were in line with expectations whilst the corn figure has been described as “disappointing”.

- Brussels has issued weekly wheat export certificates totalling 549,963 mt, which brings the season total to 20.09 million mt. This is 3.98 million mt (16.55%) behind last year. Barley exports for the week reached 130,012 mt, which brings the season total to 4.14 million mt.

- With EU, and notably French, wheat trading at a discount to UK wheat we are seeing the UK transition to becoming a net importer of the grain. There remains little evidence to suggest this trend will change in the short to medium term and reports of cargoes trading into UK mills has led to a reduction in UK consumer aggression. New crop prices in the UK remain too expensive and if the UK is to export its usual harvest volumes we will have to see a major price adjustment in order to regain competitiveness.

- Western EU wheat growing regions are in need of rainfall in the next two weeks; private crop forecasters have highlighted the need for moisture as the crop is in the joint or late joint stage. Better rains are forecast for parts of Ukraine and Russia in the coming 7 – 10 days, and are needed after some 30 – 40 days of dryness.

- US markets are seeing corn and soybeans a touch firmer whilst wheat prices have eased slightly.Wheat is again struggling in the face of active corn/wheat spread trade and as we approach the end of the week there is a firmer note to the market with further fund short covering noted.