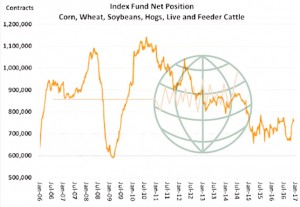

- Funds continue to pile into new length in the commodity space as measured by the CFTC Index fund positions in ags. For the year, commodities are up around 18% as an asset class, which has some fund managers taking note. One way to participate is through index fund purchases, and we suspect that funds will continue to push additional investment into the commodity space into early 2017. This is one reason why the ag markets have not traded very “fundamental” since early autumn.

- Today has seem March ’17 Chicago corn push above the $3.61 resistance level whilst soybeans have traded either side of unchanged as the market vacillates between paying attention to coming rains in Argentina and S Brazil or the tightening soybean meal market in China on account of crush plant closures allegedly due to environmental reasons. Many are suggesting that fresh money (which should always be watched closely) is being pushed into index funds and this is having its effect on prices. Fund managers are looking at record high US equity prices, the tightening US labour market and the slosh of cash that is circulating the world and chanting “inflation”. “Trumponics” and the expected fiscal stimulus has unleashed more confidence in US political leadership, which is helping the velocity of money. Whether it is crude oil, cotton or cattle, the markets are seeing better demand and this is helping higher prices.

- This week’s jump in crude oil and unleaded gasoline prices is causing huge margins for ethanol producers. Calculations put the ethanol futures crush margin at the highs of the year above $1.23/gallon with plant margins close to $.40/gallon over all costs. Both are some of the best production margins in years, which has plants/producers looking for cash corn and willing to secure futures to lock down future profits.

- The closure of 6-8 Chinese crush plants for a week has further tightened domestic soybean meal supplies within China and pushed their soy crush margins to a three year high. The exceptional margins has Chinese crushers looking to secure soybeans on any Chicago weakness. A further decline in the value of the Yuan vs. the US$ is likely to keep pulling Chinese soybean demand forward. China has already crushed 2 million mt more soybeans in the crop year to date than last year.

- More traders are talking inflation price trends that could keep Chicago prices heading sideways to higher into the year end. Brazilian and Argentine farmers are not willing sellers fearing further losses in their currency. Our mindset remains one of looking for some additional gains into year end as funds place inflationary bets at the Chicago Board of Trade. A 50% recovery of the summer decline crosses at $3.72 basis spot Chicago corn futures – watch this one carefully!