- US crop condition data has been released as follows:

- Key in the data above is that US spring wheat condition is at its lowest level in nearly 30 years. Only 46% of the crop is rated good/excellent as shown above, a 10% reduction week on week. The rating reduction was greater than trade expectation and created a stir in the market place with prices spiking sharply higher. Higher protein wheats, particularly in the US, are under a greater degree of pressure, and that appears to be translating into other origins, and will likely weigh on other wheat grades too in the fullness of time.

- Tuesday saw soybeans trade an “inside day” leaving both old and new crop contracts about unchanged, but well below early session highs. Weather forecasts continue to hold the attention of the trade with current dryness directly opposed to the wetter forecast, which has rainfall across the entire cornbelt in the latter part of the week.

- Corn futures followed wheat to a modestly higher close with the main issue not so much near term rain but more “what is the trend next week and beyond”. There is an expectation for improved soil moisture levels in the coming week but the six week outlook is key and whether drought expands or declines in that period will be a determining factor in price direction. There is talk around that China will eliminate its value added tax on DDG imports but there remains anti-dumping and anti-subsidy tariffs that will hamper any major DDG import in the near term. It is the longer term policy that will be of interest.

- Wheat, as mentioned above, rallied strongly as the market digested the latest crop ratings, particularly the spring crop. The Dakotas received decent rains in the last day or so but it seems spring wheat development, particularly in SD has gone beyond the point of recovery, and warm/dry conditions look set to return there before long. The outlook for the SD crop is not good. Winter wheat markets followed as did fob offers in Black Sea and Europe.

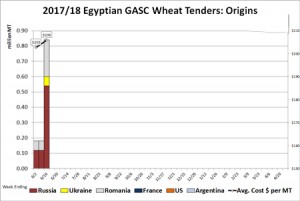

- Egypt’s GASC secured another purchase this week, the second, in which Russia, Romania and Ukraine were the selected origins. The latest price paid was a shade lower than the last tender at the weekend, at $193.50 basis fob, but includes (we believe) a modest premium on account of the current zero tolerance policy on ergot contamination. We would mention that Egypt secured wheat in early July a year ago at $163/mt, basis fob, and though that was more of a harvest position, world cash markets now hold a slight premium to year ago levels. This is especially true in N Europe. Without a major and rapid change in spring wheat crop conditions, work suggest a yield of 37-39 bushels/acre, which in turn makes the HRS balance sheet untenably tight. US HRW wheat end stocks could tighten to 360-380 million bu or 200 million less than 2016/17. Early seasonal lows appear to have been forged.