- Today has proved interesting on the first day back after Friday’s WASDE report with what can only be described as a bullish session amid what we originally interpreted as a bearish report. There is a distinct lack of fresh information and the US old crop fundamentals of cold and wet as well as tight supplies appear to be the drivers today.

- US corn planting weather would seem to have a good three day window as temperatures rise and a dry conditions prevail, for now. We know that the serious corn growers can hit some big acres when necessary, and now would seem to be “necessary”. Whether or not this small window is enough to get the necessary acres into the ground or not remains to be seen.

- We note with interest the especially dry and hotter conditions in Texas where the condition of wheat rated poor/very poor is at 70%. Cattle growers may well use wheat fields as grazing and consider planting an alternative, sorghum or cotton, which may leave as much as two thirds of the state crop unharvested.

- According to China’s CNGOIC (China National Grain & Oils Information Centre) the country, which is the world’s second largest consumer of corn, may well increase its corn output by nearly 3% and wheat by just over 1% this year. The corn harvest, if realised, would reach 214 million mt and leave imports for 2013/14 at around 5 million mt, nearly double the current year’s estimated import volume. This figure, whilst large, is less than that forecast by the USDA on Friday, which stands at 7 million mt. Their wheat harvest, as the world’s largest producer, would stand at 121.8 million mt, mostly a winter sown crop.

- Last week Brussels issued wheat export certificates totalling 284,484 mt bringing the season total to 18.926 million mt with eight weeks to go. The season is 5.217 million mt ahead of the same time last year (38%).

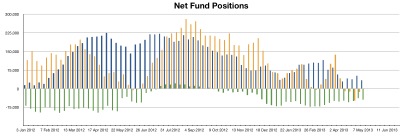

Fund net positions in CBOT corn returned to a positive figure (just) after a four week sojourn in “short” territory. Soybean net longs reduced slightly and wheat net short positions increased to a slightly larger net short. The cumulative position reveals a relatively small position from an historic perspective.

Fund net positions in CBOT corn returned to a positive figure (just) after a four week sojourn in “short” territory. Soybean net longs reduced slightly and wheat net short positions increased to a slightly larger net short. The cumulative position reveals a relatively small position from an historic perspective.

- Finally, Oil World today estimated the EU rapeseed output at a three year peak of 20.2 million mt as winter crops (UK excepted) appear to be performing reasonably well. Crop conditions in Australia, due to dry conditions, as well as S Russian and Ukraine crop concerns continue to be a factor to watch.