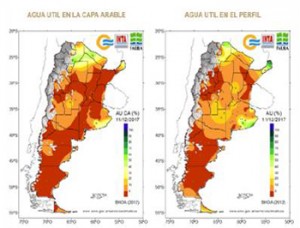

- Next week’s Argentine rains are extremely important for their corn/soy yields. Weather modeling argues that some damage has already occurred to the Argentine first corn crop that will pollinate in the next 21 days. Also the delay in soybean seeding is also producing a modest yield drag. The maps below reflect Argentine soil moisture as of December 11. In particular, subsoil moisture has been in fast retreat in the past two weeks, thereby raising the importance for a soaking, not just passing rainfall event.

- It has been a morning of grain vs. soy spreads as hedge fund managers start to come out of long held positions. Funds have spread long soybeans against grains going back to late summer, which has generated profits. Funds desire to close a modest portion of the position which has pressured the complex and produced a bid under the grains. The volume of Chicago trade has been low and most are not looking for any excitement into the holiday’s unless S American weather forecasts change. Chicago brokers estimate that funds have bought 2,300 contracts of corn and 2,100 contracts of wheat, while selling 4,800 contracts of soybeans. In soy products, funds have sold 3,100 contracts of soymeal and bought 800 soyoil. Chicago meal and soybean prices are also being pressured by chart based considerations with soybeans under an uptrend line and January meal testing the November 30 low at $322.50. A drop below this support would potentially confirm a top.

- Rumors of a potential reinstatement of the $1.00/gallon US Biodiesel tax are being heard this morning. This is due to several ag state senators fighting hard for its return in early 2018. Senator Grassley from IA has been a strong proponent of the biodiesel credit and congressional staffers are raising their odds that the tax credit could return and be retroactive. It is something to watch heading into the Christmas break.

- The Rosario Commodity Exchange raised their wheat crop estimate to 17.3 million mt from 16.3 million, left their corn crop estimate unchanged at 41.5 million mt, and slightly adjusted their soybean crop estimate up to 54.5 million mt from 54.4 million due to larger seeding. USDA Argentine crop estimates are all higher.