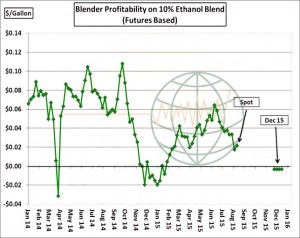

- The ongoing decline in crude and gasoline is expected to weigh on ethanol production and blending longer term. ARC has no major disagreement with the USDA’s new crop 5,275 Mil Bu corn used for ethanol forecast, but the issue ahead surrounds discretionary blending. New crop ethanol production margins are calculated at just $.15/Gal, and futures-based blend margins are slightly negative. The incentive to produce above government mandates is lacking, and ethanol prices are expected to drop further over time.

- Selling returned to the soy complex on Friday and beans and meal ended lower. Market news at the end of the week was limited, but the November soybean contract registered the largest one-week loss in more than a year. Next week will bring another flood of fresh fundamental data for the market. On Monday, July crush data will be reported by NOPA while the USDA’s FSA office is scheduled to report certified acres as of August. The crush report is expected to show a large July processing total, but at this point in the year will have little (if any) impact on prices. The certified acreage data in recent years has received a lot of attention on release days, but has not proven to be a reliable indicator of any changes in acres. Additionally, a number of private crop tours will be underway, most notably the Pro Farmer Crop tour, with yield estimates to be released at the end of the week. The USDA yields this week was one of the largest surprises on record, so the trade will look to the Pro Farmer estimates for confirmation. Our view is that rallies will continue to struggle under excess US and global supplies. Initial price resistance is expected above $9.30 basis November ’15 futures and our initial downside target rests at $8.50-8.60 by harvest. Any short covering rallies should be viewed as selling opportunities at this time.

- Corn futures settled unchanged on Friday, and ended the week down 8 cents. Corn-soybean spreading was noted amid heavier rain forecast for the vast majority of the Central US. This will affect soybean yield more, but this too will be favourable for late developing corn. Additional long liquidation is possible next week if the current US forecast materialises – latest forecasts project rainfall of .50-3.00” across the whole of the Corn Belt next from mid to late next week. Near normal temperatures are scheduled for the last half of August. Crop condition reports on Monday are expected to be steady to down 1% following this week’s dryness across the C and E Corn Belt, as conditions historically decline in late summer. A counter-seasonal boost is possible if next week’s forecast rain actually falls. Pro Farmer’s crop tour kicks off Monday and conditions in the Eastern Corn Belt, specifically, will be widely followed. With NASS’s August crop report now digested, the goal of the market is to boost domestic and export consumption in an era of weak Chinese growth, eroding ethanol production and blend margins and steep competition from other major exporters. Supply driven rallies (based on FSA acreage data or upcoming Crop reports) will provide selling opportunities. Severely adverse S American weather this winter is needed for lasting bull run.

- US futures ended steady to 5 cents higher on Friday and settled down 5-8 cents on the week. There’s little fresh news available, but the session was marked by funds buying grains and selling soybeans amid ongoing improvement in next week’s Central US weather forecast. We continue to believe that rallies in the weeks ahead will be short-lived – Gulf SRW basis rallied sharply this week, which along with support in the futures market has further widened the US’s premium to other origins. Russian domestic prices in US$ terms, as evidenced in the graphic below, have fallen to seasonal lows and range from $3.75-4.20/bu. Australian weather will increase in importance beginning in late August, and following recent rainfall a drier than normal trend is offered to Southern and Eastern production areas in the next ten days. But there’s been no end to declining Black Sea cash markets of late, and some are now pegging the Aussie crop at 24 million mt, unchanged from ABARES’ first estimate in spring. New fund long positions hinge upon an Australian drought in September. Fundamental resistance is pegged at $5.20 basis December ’15 Chicago futures.