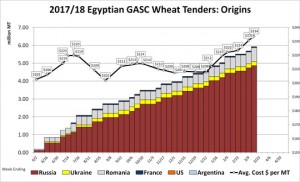

- Egypt’s General Authority for Supply Commodities (GASC) purchased 240,000 mt of wheat at average price of $233.71/mt basis C&F. Russia and Romania sold 120,000 mt each. Prices continue to reach new highs for this season. The origins are by no means surprising, but the price of execution is the highest in three years. The US market is no doubt overvalued, but downside risk in EU/Black Sea offers appears limited into the new N Hemisphere harvest. Fundamental support is pegged in May Chicago wheat at $4.65-4.70.

- It has been another mixed morning in Chicago, seemingly driven by US weekly export sales. Corn and bean sales were at or above expectations, while wheat demand continues to suffer from lofty prices (relative to other origins), and it is possible that the USDA will hike old crop HRW stocks further in its April WASDE, thus further buffering against new crop yield loss. Corn is down a shade, beans are up 8-12, and wheat futures at all US exchanges are down 3- 8 cents at midday. Through the week ending March 8, the US sold a net 99 million bu of corn, a new marketing year high and the largest amount since late 1994. Total US corn sales since Jan 1 rest at 688 million bu, vs. 379 million in the same period a year ago, and additional demand lies in the offing through late spring. Soybean sales totaled 47 million bu, down from the prior week but up 29 million from the same week in 2016, and some interest is being funnelled back to the US following this year’s crippling drought. Wheat sales were a meagre 6 million bu, including just 0.3 million of HRW, and without improvement in the final throes of the market year, it is possible the USDA’s US wheat export forecast is still 10-15 million bu too high.

- NOAA’s updated spring and summer climate forecasts are slightly improved across the eastern and northern Plains through June, but unchanged elsewhere. Heat and dryness (and thus ongoing drought) will be featured across the S Plains over the next 90 days. Normal/above normal precipitation is offered to the N Plains and Midwest, and as expected much of NOAA’s update centres on a transition from La Niña to neutral ENSO conditions this spring. The summer forecast is of course much too far off to place any confidence in, but amid warming N Pacific and Atlantic Oceans, bouts of heat are likely across much of the Central US Jul-Sep.

- The Rosario Grain Exchange in Argentina has lowered its corn production estimate to 32 million mt, vs. 35 million in Feb and vs. the USDA’s 36. With the extended range outlook trending drier, worst-case scenarios are becoming increasingly likely, and a final harvest number of 30-31 million mt is possible. As such, we expect breaks in corn prices to be shallow/short lived until early US crop conditions are confirmed to be at/above average. The big change in recent weeks has been in the US corn balance sheet, and a sizeable crop is now needed for the bears to find leverage.

- The Argentine forecast is unchanged over the next 10 days, and so is still nearly completely dry across 80% of the primary crop belt. The midday GFS weather forecastis much wetter in 11-15 day period, advertising totals of 2-4” across Cordoba, Santa Fe and Entre Rios. The models in recent days have flirted with a pattern change there by late March, but confidence in this is low, especially given drier trends in overnight EU and Canadian weather model outlooks.

- The markets are consolidating ahead of NASS’s planting intentions reports, and new trends won’t likely be established until afterwards. Corn’s story is most compelling, longer term, via a lack of acreage expansion and rising export demand.