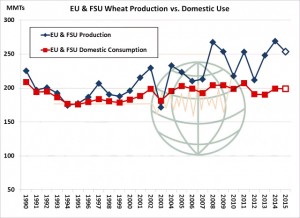

- In the May WASDE, the USDA projected combined EU and Former Soviet Union wheat production in 2015 at 253.7 million mt, down 16 million mt from the previous year, with combined yield down 7% at 3.41 mt/ha. We have no problem with the EU’s yield, but note that the Black Sea’s projected yield at 2.16 mt/ha is some 6% below the 20-year trend. Using a trend Black Sea yield would add 7 million mt to production. Carryin stocks are up 11 million mt from the prior year, and notice in the graphic below that domestic wheat use has been relatively flat – and is forecast down fractionally from 14/15. Production will exceed total domestic use for a third consecutive year, and by a sizeable margin. The EU and Black Sea will be the world’s top wheat exporting regions again in 2015. The beginning of winter wheat harvesting is just weeks away.

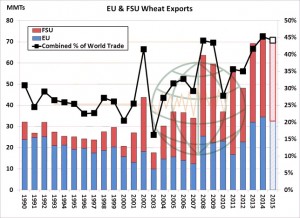

- Combined EU and Black Sea exports will be down just slightly from last year at 69 million mt, with their world market share steady at 45% of total global trade. We expect exports to be closer to – or even exceed – last year based on favourable growing conditions, current vegetation health maps, and upward revisions to Russia’s crop in coming months. The USDA also projects the US’s share of world trade to rise in 15/16, but this will be a struggle, as we have previously suggested. However, the point is that with the EU and Black Sea combining for half of world trade, cash prices there will determine world prices – including US futures. US supply and demand has become far less relevant in recent years, as its share of world trade has fallen from 30% in 2007 to 14- 16% currently.

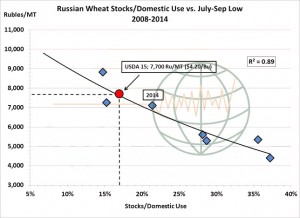

- Seasonal lows in Black Sea domestic prices are often scored in July/Aug, and are largely a function of Russia’s exportable supply. Below is a graphic comparing Russian stocks as a percentage of domestic use, vs. seasonal lows in domestic prices in Southern Russia – where the majority of exports originate. The USDA’s balance sheet as it stands now suggests lows will be scored at 7,700 Rubles/mt. The price in Rubles is higher than last year, but the price in US$ is weaker amid this year’s collapse in non-US currencies. At today’s exchange rate, this equals $4.20/bu. This also suggests Russian fob offers will fall to $180/mt (vs. $187 currently) for seasonal lows, which is comparable to $4.30- 4.40, basis July CBOT assuming Gulf basis levels of $.60- .65/bu. A $4.25-4.75 summer/autumn range is needed for US wheat to compete in the world marketplace.