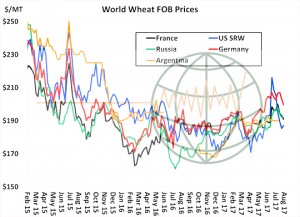

- US wheat prices have collapsed in the past four weeks and are now sitting at values that are below where the rally started in April. US wheat was the most expensive in the world at the start of July, is now it’s the cheapest by a wide margin. Russian, Argentine, and EU wheat offers have been slower in their decline while Aussie wheat prices are well above all other exporters on declining new crop supplies. Also notice from the chat below that all fob world wheat offers are well above last year. In fact, Russian farmers are not selling even with prices $30/mt higher and a record large crop.

- Soybeans were on both sides of unchanged in Wednesday’s trading, and steady to marginally higher at the close. The soy market is very oversold and news that a Chinese delegation of importers had signed agreements to purchase 3.8 million mt of new crop soybeans offered support. However, this is an annual event, and (somewhat cynically) we feels this is more a statement of intent rather than a formal commitment. Soybean oil marked the best close for the day with December bouncing off both an uptrend line and the contract’s 100-day moving average. Last week’s Commitment of Traders report showed that funds had started to unwind their soybean oil position, which was the largest since February. We estimate that since last Tuesday, funds have sold 11-12,000 futures contracts, but still hold a significant long soybean oil position. We question the need for soybean prices to fall much under $9.20 basis November ’17 futures, with a drier extended weather forecast and the skepticism that surrounds the USDA’s August yield estimate. Our opinion is that a short term bottom is forming ahead of the Pro Farm Tour that starts Tuesday.

- Corn futures fell to new 11-month lows, but selling slowed as the GFS and EU weather models project a lengthy period of dryness in late August. US ethanol production last week was also much higher than expected. End user demand will emerge on any further break; yield checks suggest NASS is too high with its IL yield. US ethanol production for the week ending August 11th totalled 311 million gallons, up a full million from the previous week and just 0.5 million shy of the all-time record posted in late January. Cumulative ethanol exports in 2017 remain record large. The highlight in energy markets is still the ongoing decline in US crude stocks, which as of last Friday are down 4.9% from the previous year. Crude will have ample support at $45/barrel, and as such biofuel margins will stay profitable. Argentine fob basis for Sep delivery has rallied every day this week, and this evening is quoted at $.30/bu over. This is up some $.40/bu in just a few weeks. Brazilian corn is now offered at a premium to US origin. The market is probing for a lasting bottom, which we would expect to be found at $3.55-3.65 basis Dec ’17 futures. The S American market has bottomed, and major exporter supplies will be down some 45 million mt from last year. The US farmer will need to plant additional corn acres in 2018.

- Egypt managed to buy a hefty 355,000 mt of Black Sea origin wheat at $194/mt, or roughly $12/mt below what it paid in its last tender. Some 1 million mt of Russian wheat was offered, and the Black Sea cash market is noticeably weaker. Work indicates that the market is in the process of forming a lasting bottom, but we await interior Russian cash market price action for confirmation. Australia’s longer term climate outlook is trending wetter following updated ENSO guidance. Very little rain will fall in Australia in the next ten days, and so vegetation health is expected to erode further, but thereafter there is evidence to support an improved pattern of rainfall in the Sep-Nov period. Aussie wheat is still rather expensive, but fob prices there have lost some $30/mt (12%) in the last four weeks. Larger than expected Russian production, more aggressive Russian sales this week, and a shift in Oceania climate outlooks have weighed rather heavy on values in August. Rallies in the near term will hard fought. However, we estimate managed funds position in Chicago today to be net short 50,000 contracts, and very quickly funds’ position has undergone a 100,000 contract swing, from long to short. The decline has been dramatic, but it is not the time to turn bearish with seasonal trends in both corn and wheat pointing upwards beyond late Aug/early Sep. Producer revenues in most exporting countries are lower than last year, and Russia’s logistical constraints will cap its share of world trade. Gulf wheat is very cheap and futures are undervalued.