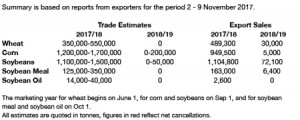

- US export data has been released as follows:

- Of all things, rain across E Australia is starting to become a concern for the mature wheat crop! Reports are emerging that damage to recently harvested wheat is being found, and that with upcoming rains, the quality decline could become more important. We suspect that it will be some 5 to 10 days before wheat traders in New South Wales and Victoria will push any panic buttons, but the weather forecast will become more important to world wheat pricing going forward. It should be noted that W Australian weather is ideal for harvest, so there will be blending opportunities of west vs east.

- Continuing with the weather theme, the nearby Central US forecast is again little changed and the EU, GFS and Canadian models remain in good agreement. Rain/snow and cooler than normal temperatures in the next 10 days will favour the eastern Midwest. Totals in excess of .50” will stay isolated to IL, IN, OH, MI, KY and PA. Near complete dryness persists elsewhere, and it remains that this pattern likely holds into the opening week of December. As expected, abnormal dryness expanded slightly in TX, OK and AR, and will expand further in the next 30 days. Longer term, NOAA’s latest winter climate outlook accounts for the arrival of La Niña. Typical of La Niña winters, warmth and dryness will favour the Southern US, while extreme cold is likely in Canada and the far Upper Midwest. NOAA’s associated drought outlook calls for drought development in the Delta/Southeast. Drought in the Northern Plains will be ongoing into late February.

- It was a slower and lower day of trade in the soy markets, that left soybeans down 3-4 cents at the close while the soy product markets gave back gains and finished lower. News for the day was limited to the export sales report, which did not offer any significant surprises. Commodity funds were estimated sellers of; 4,000 contracts each in the soybean and soyoil markets, and sold 2,000 soymeal. The Buenos Aires Grain Exchange on Thursday estimated soybean planting progress at 24% complete, unchanged from a year ago but behind the 5 year average of near 32% complete. The Exchange held it’s estimate for soybean area steady at 18.1 Mil hectares, down 1.1 million from last year. Heading into the weekend, the soy markets will continue to struggle for direction. The US harvest is winding down and cash basis is recovering, but still holding at multi year lows. Next week is a holiday shortened trading week, and choppy markets look to continue. We look for spot soybeans to hold a broad range of $9.50-10.20 into year end with normal S American weather. Argy dryness is currently a concern.

- Funds expanded their net short position in corn slightly (now estimated at 251,000 contracts) and overall fresh news is lacking. What news is available, however, is somewhat supportive. As expected global climate updates now account for the arrival of La Niña, and so feature warm/dry weather through winter in Argentina, S Brazil and Southern US. US weekly export sales totalled a decent 37 million bu, down sharply from last week but only 27 million per week is needed to meet the USDA’s forecast, which was revised upwards in last week’s report. Japan was a massive buyer last week. Argentine planting this week has reached 35.4% complete, up just 0.4% on the week and compared to 40% on this week a year ago. Sustained weakness in S America’s market is not expected until mid-summer, and recall Argentina’s crop won’t be fully gathered until August. The market is set up for a decent rally should Argentine dryness continue into December. The world farmer has halted sales.

- US and European wheat futures ended unchanged. Both markets have found support at or near recent lows, and fresh news today is mixed. Egypt secured a hefty 240,000 mt of Russian wheat at $195/mt, basis fob, down another $1.50/mt from its purchase last week, despite renewed uncertainty over Egypt’s ergot tolerance, or should that read intolerance, and clearly it is still a buyer’s market. Russian quotes today are a bit weaker; EU cash markets are unchanged. US weekly export sales totaled a decent, but not great, 18 million bu. This is down 10 million on the previous but slightly above what is needed to hit the USDA’s target. Traditional importers have stepped up coverage following the recent break, and we look for steady US export demand into late year. Argentina’s harvest is 12.5% complete, but yields remain disappointing. As of this week, wheat yield there is averaging 1.5 mt/hectare, vs. 1.8 on this week a year ago. The Beunos Aires Grain Exchange maintains its production figure of 17 million mt, but this could be 2 million too high if yields don’t improve in the next 15-30 days. Along with potential flooding in Australia next week, S Hemisphere production is a concern. Seasonally price trends are broadly supportive into late year.