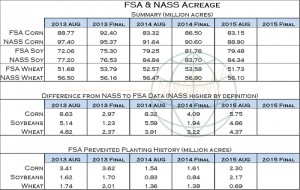

- This morning, the FSA division of the USDA published their first round of monthly data featuring a snapshot of what registered certified acreage and prevent plant are at so far this season. The data is not considered viable until October when NASS (the statistical division of the USDA in charge of estimating planted acreage) will use the data to support their estimates. Typically, this leads to a change in planted acreage in the October Crop Production report. There are always a few key things to keep in mind while analysing this report: not all acres are certified/registered, there is no indication of farmer reporting pace compared to previous years, there is no indication of FSA database entry rates compared with previous years, and even small things such as staff size at certain offices can have an impact on the numbers, there is not a fixed acreage spread from NASS to FSA, and the month to month change in the FSA data is not consistent.

- Consequently, we have to bear in mind that:

- The data is neutral to bearish, we will call it neutral because the of the preliminary nature of the data, and the lack of a consistent tracking between FSA and NASS.

- August acreage numbers are similar to last year. From this data alone, NASS corn acres could be too low. NASS soybean acres are correct.

- Prevent plant acreage (which does not normally change much from Aug to Final) is elevated from last year at 5.2 million acres. 5.2 million is on the lower side of expectations. Some are estimating 2015 PP at 6.3 million.

- The Pro Farmer Midwest Crop Tour’s initial corn and soybean yield potential,on day one of their annual tour, suggests that yields are showing potential for an above average figure. Today’s data is based upon west-central Ohio, which is trending above average whilst crops further north were showing the effect of excess rains in spring. The final results of the tour will be published on Friday, and whilst interim data is of interest, it is really the final figure we are looking for.

- NOPA (The National Oilseed Processors Association) today released data showing its members crushed a record 145.22 million bu of soybeans during July, about 3-4 million bu above trade expectations. US soybean oil stocks rose to 1,624 million pounds with meal exports pegged at 590,582 mt. The crush data was seen as supportive, but the CBOT rally was short lived as favourable Central US weather continues to raise US soybean yield expectations.

- Black Sea wheat prices continue to decline to new lows as tepid demand and rising Russian wheat crop estimates continue to offer pressure. We have heard that Russian 12.5% wheat is offered as cheap as $181/mt with bids at $177.00. The lack of demand for Russian wheat is pushing traders to become more aggressive with offers as they think ahead to the cold of autumn, which is not that far away!

- Midday US weather forecasts look favourable with a mix of rains and cool temperatures into the end of the month. Chicago markets are heading into the close on a lower note tonight.