- Despite our earlier thoughts it appears that we now have a de facto ban on exports of Russian grain due to phytosanitary certificates being refused to all but Egypt, Turkey, Syria, Armenia and India. Bear in m ind Egypt and Turkey took 7 million mt between them last year out of the 18.5 million mt of total wheat exports. Syria, Armenia and India are on the list but account for minimal tonnage and appear to be a political gesture rather than anything else.

- Some 15 million mt has been shipped through to mid-December, and there is a risk that some 7 million mt, based on the USDA’s full year export estimate, is at risk – less anything else that can be exported to Egypt or Turkey. The trade is staring default and force majeure all over the place and one thing is clear, and that is that huge sums of money will be lost. One other point should not be missed, and that is that Russia is still living in the old Soviet era, and has not come to terms with today’s modern world and the way is operates. Regrettably, memories are all too short, and next year most will doubtless “forget” and business will resume “as usual”.

- Unusually, loaded vessels are currently prohibited from sailing, further compounding problems for shippers, traders and receivers alike. Egypt’s response was one of “confidence that Russia would fulfil its obligations”, and stated that Russia would remain as an origin for further tenders. Further commentary from elsewhere has affirmed thoughts that sufficient wheat remained in alternate origins to ensure the grain did not succumb to any shortage or suggestions of such.

- Away from Russian wheat, it appears that US ethanol producers are to shortly follow in the footsteps of their EU counterparts as a consequence of the sharp fall in crude oil and unleaded gasoline prices.

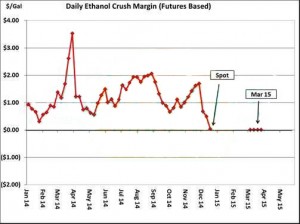

The chart shows that marginal profitability exists today but by the end of Q1 current corn and ethanol prices will put margins into the red. Blender margins in the US are already negative and the incentive to grind more and more corn appears to be dissipating slowly but surely. The current oil oversupply position looks set to last, possibly for some years, and the ethanol producer’s profit incentive has been cut – significantly from where it has been in recent months.

The chart shows that marginal profitability exists today but by the end of Q1 current corn and ethanol prices will put margins into the red. Blender margins in the US are already negative and the incentive to grind more and more corn appears to be dissipating slowly but surely. The current oil oversupply position looks set to last, possibly for some years, and the ethanol producer’s profit incentive has been cut – significantly from where it has been in recent months.