Weekly CCI Analysis:

The CCI/CRB index closed higher for the 5th week on a row on rising energy, livestock and metal prices. The week ahead is important to gauge if the CCI can rise above the initial January highs? A close above this resistance would argue for further gains into early June. Fund managers have looked upon raw material prices as historically cheap – and they are based on price data since 2005. However, there is no evidence of any demand growth for energy, ags or metals. This means that oversupplied markets are likely to return at some juncture. The US$ has been in a corrective price phase since March and a turn higher in the greenback is expected during June. The US economy continues to find traction against a soft world economic outlook.

Longer-term soybean analysis:

Soy futures fell sharply following the release of the May WASDE report and then traded quietly lower at the end of the week. July soybeans ended just above support at $9.50 (see weekly chart below). The USDA slightly increased their estimates for old crop soybean use into the end of the year, but the carryout projection remains at multi-year highs. Cash basis bids are holding at multi-year lows and the end user is adequately supplied. Processors are thought to be covered through mid-June. In new crop, US planting progress will have likely surpassed the 50% mark through Sunday and growing crops have been adequately watered in most regions of the country. The upcoming warming trend should jump emergence rates and initial crop ratings (expected in 2 weeks). China has been a very slow buyer of US new crop soybeans and is opting for Latin American soybeans instead. A drop under $9.50 basis July is expected to trigger another round of fund selling down to the September low, with good growing season weather to pull November under $8 by harvest.

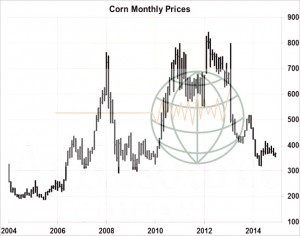

Longer-term corn analysis:

Corn futures ended up 2 cents this week, largely in sympathy of the US wheat market. The USDA’s new crop balance sheet was revealed mostly within expectations, but in our view its demand growth forecast is overstated, and with favourable US weather projected into July, 2015/16 stocks are likely to exceed 2,000 million bu. USDA’s new crop export forecast of 1,900 million bu is especially debatable, given that Ukraine is now offered corn at a steep discount to US Gulf origin into early 2016 and Brazil offers have returned from July forward. The May WASDE also featured a sizeable increase in Chinese feedgrain stocks. The market’s goal through the next 12 months is for the US to better compete with Black Sea and S American exporters for world trade, and to maintain profitable ethanol production and blend margins. Well above average initial US corn crop conditions are anticipated. Dec above $4.00 is a sale in our opinion with harvest lows expected at $3-3.30. End users are likely to support July below $3.50 pre pollination

Longer-term wheat analysis:

US wheat futures rallied 25-34 cents this week with KC pacing the advance. The trade has cited ongoing rainfall across the S Plains, dry 2-week forecasts across Siberia and uncertainty over Russia’s 2015/16 intervention price target, but in reality, funds were just too short. Non-commercial traders as of early this week held a record short position worth 115,000 contracts, and 25,000 were covered this week. We note that world cash markets end the week just 0-5% higher (vs. the 7% rally in US futures) and the outlook into summer is little changed. Russia has eliminated its tariff on wheat exports and the current intervention price suggests a floor under the world cash market at $4.25-4.501/bu basis spot CBOT. This price is also indicated in at least one major exporter surplus model. Short covering advances (like what happened this week) will occur periodically, but we maintain that seasonal lows will not be scored only in June or July. Rallies offer selling opportunities or to hedge 2015 and 2016 production.