- Yesterday in Chicago saw soybean markets lower but $10.00/bu support held and prices closed well off the early lows. Products were similarly weaker early on in the session but found support at the session moved on.

- Corn in Chicago ended higher for the fifth consecutive session again finding support at the lows. Strong demand for US supplies appears the underlying issue as Black Sea cash premiums have rallied to levels above US Gulf. US ethanol blend margins have turned positive amid the ongoing crude and gasoline price rally, which is also supporting corn cash and futures prices.

- In wheat we note that the US has reportedly sold to Algeria, a traditional French stronghold, which is maybe indicative of the concerns over French crop quality. French and German offers for Nov/Dec have reached $200/mt, the highest level in some 13 months! Chicago fund short positions continue to be pared back and this too is adding support.

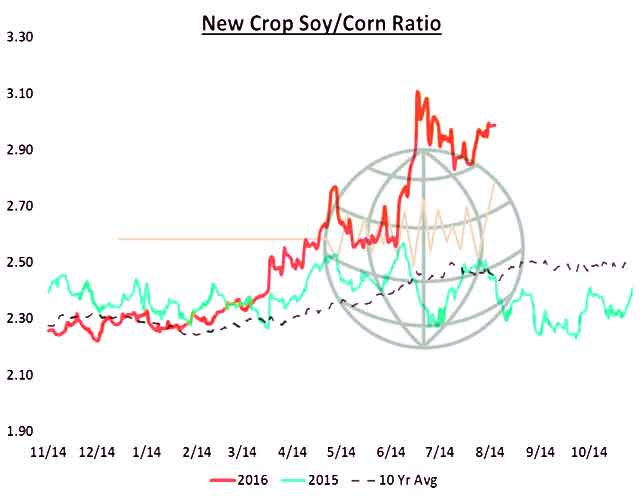

- The new crop soybean/corn ratio pushed to a high in late June of 3.1:1, and since held in a very wide range, at historically strong levels. The only other year that the ratio has held so strong at this time of year was in 2009. The ratio is often used as a guide to potential acreage shifts ahead of planting, but once crops are planted becomes a function of each commodities individual supply and demand outlook. This year, it’s the record corn yield and the monstrous soybean export demand that has held the ratio at historic levels.

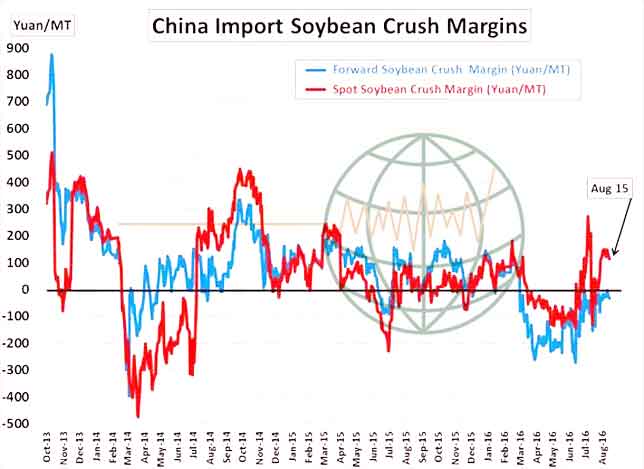

- Chinese crush margins have recovered to their best levels since February as soybean oil demand/price recovers. The chart below reflects that Chinese crushers are back to making money! Chinese crushers are securing US soybeans trying to lock down domestic margins. We are told that an additional 4 to 6 cargoes of US soybeans sold to China Thursday and for the week to date, China has secured 20 to 25 cargoes. Brazil and Argentina are sold out of old crop soybeans and the US will export record large totals of soybeans through January. It’s this demand for US soybeans that helps absorb record large yield/production.