- US crop condition data has been released as follows:

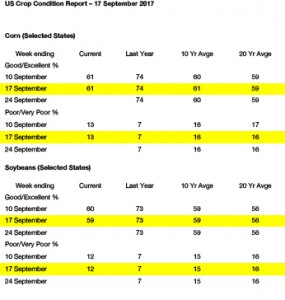

- Soybeans rallied from the morning opening on export sales announcements that totalled 387,000 mt. However, November soybeans found resistance back above the contract’s 50 day moving average. The soy product markets finished sharply mixed, with meal leading the complex higher, while soybean oil followed Malaysian palm oil lower. NASS reported national good/excellent soybean crop ratings at 59%, down 1% from last week, while national harvest was 4% complete. (IA good/excellent ratings declined 3% for the week to 58%). While late season rains in W Iowa offered late summer relief, crop ratings remain well under the long term average and well below a year ago. We note that NASS’s implied pod weight for IA was 8% over last year and record large, while the September pod count was at a four year low. Nearby support was established last week under $9.50 basis November futures, while the market awaits more harvest data to determine a yield trend. Our view is for lower yields in October, when actual harvest data can be incorporated into NASS’s projection.

- December corn has been unable to exceed its 20-day moving average since early summer, and again failed to do so today. Otherwise, it was a rather slow day, news wise, and crop maturity should at least catch up with average in the next two weeks as abnormally warm temps are sustained. We would also mention that EU/Black Sea feed wheat prices continues to move higher, which should allow for better corn demand into East Asia from all origins. Maturity as of Sunday reached 34%, vs. 50% on this week a year ago and a longer term average of 45%. No frost is indicated, and in fact abnormally warm temps will stick around for another 6 to 7 days, but with maturity well behind normal in ND, SD, MN and IA, US temperatures will be worth monitoring into the first week of October. good/excellent ratings are unchanged at 61%; harvest is 4% complete, vs. 11% on average.

- Another round of sub-freezing temperatures were recorded across much of New South Wales over the weekend, but US wheat futures instead failed at tech resistance, and also extracted some premium amid a rather wet pattern forecast next week across the HRW Belt. Winter wheat planting through to Sunday reached 13% complete, vs. 15% a year ago. Egypt’s GASC is once again seeking optional origin supply for late October shipment, which again we would expect be filled by Ukrainian/Russian origin. The Black Sea will dominate world wheat trade into late autumn. However, as that market finds demand, prices continue to rise. Russian wheat for spot arrival is offered at $188/mt, vs. $180 just weeks ago, and Russia’s discount to other origins is narrowing. Do not ignore this year’s loss of S Hemisphere wheat, and as such the US market will be well positioned to capture world demand beginning in winter. Other than periodic short covering, rallies will be tough over the next 6-8 weeks, but we maintain seasonal lows were scored in late August.