- The week can best be described as “messy” with little in the way of defining news, old stories continue to be regurgitated and rehashed but have stimulated limited price direction.

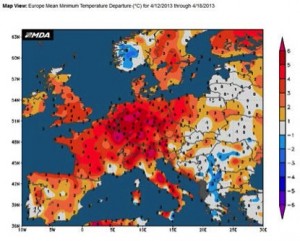

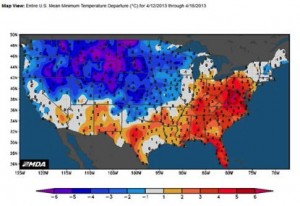

- Europe and US weather patterns are almost polarised (in very general terms) with Europe much warmer and the US suffering continuing cold and freezing conditions. Whilst European conditions are changing, for the better, the on-going deep freeze in the US has been raising concern over damage to hard red wheat crops. In reality it is probably too soon to confirm or quantify damage from freezing, but added to the persistent drought and sub-soil moisture deficit, there is a very real risk in the making.

- Stratégie Grains have lowered their latest EU 2013/14 wheat output figure, for the fourth consecutive month, by ½ million mt to 131.06 million mt with the UK contribution reduced yet again, this time by 330,000 mt. The conditions in the autumn were, as we have previously mentioned, dreadful and this left around 25% of the winter crop unplanted. The much-publicised weather so far this year has done little, if anything, to aid the development of what was planted and has delayed spring crop planting too. UK wheat output was put at 11.78 million mt, the lowest in 12 years. Without doubt the weather is now the key determinant of final output; good or bad will affect the numbers correspondingly. Many are erring on the side of caution with the UK trade probably closer to 11 million mt at this moment in time.

- In the same report EU spring barley hopes for 2013/14 have also been hit following delayed plantings with output forecast at 29.29 million mt, a full 2 million mt behind last year. Total EU 2013/14 barley output, which is projected at 54.22 million mt, is just over ½ million mt behind last year. Interestingly the UK barley crop is forecast at close to 1 million mt above last year with a total output projected at 6.48 million mt, of which 1¼ million mt is scheduled to be from spring planted crops.

- Brussels granted another big week with wheat export licenses totalling 435,553 mt, which is 4.954 million mt ahead of last season (plus 37.9%). Our “cracked record” commentary remains in place, the only addition being that the end of season position becomes yet more critical.

- Finally, Egypt continues to create interest with their president, Mohammed Morsi, due to visit Moscow, presumably in an attempt to negotiate a route to further wheat supplies. Prior to the visit, the Russian Grain Union have opposed any loans of government wheat stocks to Egypt whose stock levels were this week reported at 71 days of consumption (1.74 million mt). Given the view that production estimates are already optimistic and because of restricted availability of basic inputs, we could well be looking at “emergency measures” becoming necessary to resolve what is increasingly looking like a shortage of wheat within the nation.