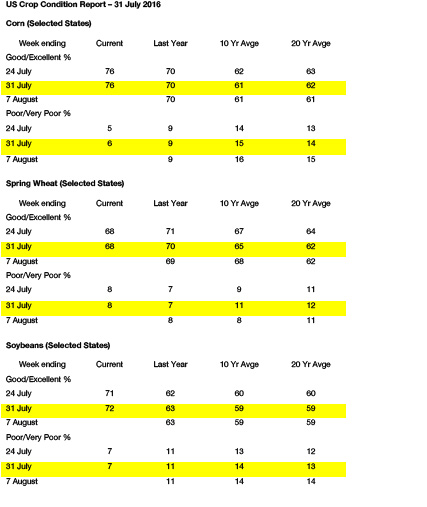

- The latest US crop condition report (detail above) has kept pressure on the US summer row crops of soybeans and corn. Added to this the latest FS Stone yield and crop estimates hit record levels and this has added to pressure. Nov ’16 soybeans breached the significant 200 day moving average support level ($9.555/bu), which sparked further selling and new lows have been scored across the big three of corn, soybeans and wheat.

- Chicago markets have been in almost constant decline since late June and the outlook for big crops should not come as a surprise to any readers who have been following our commentaries. There looks to be potential for corn and soybeans to yield as much as 5% above trend given normal weather into harvest. Should this materialise we can see Dec corn futures prices coming close to $3.10/bu, which equates to some 20 cents of downside. Clearly the market will try and retain some weather risk premium but time is eroding for this to impact yield and output significantly. With current cash prices at two year lows, end users are understandably not shy in adding to forward cover on price dips, and it is this which is a limiting factor to prices declining significantly from current levels.

- Wheat prices are following corn but global levels are rising as N Hemisphere harvest advances. Offers were made to Egypt’s GASC in their latest tender for September shipment, Russia, Ukraine and Romania were evident with France once again noticeably absent. This absence is likely a cause for less aggression seen in offers although 60,000 mt was secured from Russia at a price reported to be $177.09/mt basis C&F. Black Sea producers seem to view storage as their best financial option at present, and we would not disagree with their opinion at this time.

- Funds are still exiting stale wrong bean long positions while US crop sizes keep being talked larger amid non threatening weather. China has purchased another 4 to 7 cargoes of soybeans today out of the US. The tone of the market is bearish but we would continue to advise against becoming overly so at current low prices. September corn futures are approaching the 2014 lows at $3.185/bu while September Chicago wheat has fallen below $4.00/bu.