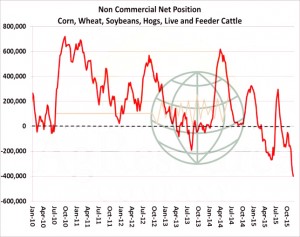

- Corn and soybean markets in recent weeks have been reacting to moderately supportive input – Monday’s EPA ruling, a lack of Argentine soybean offers, competitive Gulf corn offers – and funds’ sizeable short position has helped with the rally. The graphic below displays non-commercial traders’ net position in ag markets, and their current net short position (400,000 contracts) is the largest since the supplemental data series began in 2006. It’s difficult to be fundamentally bullish amid policy changes in Argentina and with El Niño to dominate the global climate into next summer. However, the market is increasingly lacking new sellers, whether it be farmers or speculators. Short covering rallies will develop periodically in the weeks ahead, and could well be good opportunities to make sales.

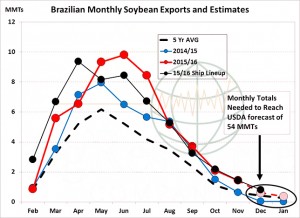

- Brazilian trade data released on Tuesday showed official November soybean exports as reported by the government at 1.44 million mt. The 2015 November total was at a four year high and the second largest on record, but also in line with expectations based on private shipping data. Both the USDA and CONAB have been forced to increase export estimates over the last several months, as their annual projections have been reached far earlier in the year. CONAB has raised their projection for five straight months, while the USDA’s most recent projection of 54 million mt is 7 million over their June projection. The chart below shows projections for December and January exports, to meet the USDA forecast, but the Brazilian lineup continues to add late year ships, and is already indicating a larger than needed export total.

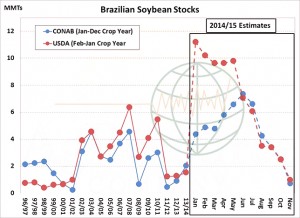

- Ship lineups have for months indicated that both the USDA and CONAB have been underestimating the Brazilian soybean export total. The chart plots the history of the two agencies ending stocks projections, by month, for the 2014/15 crop. At the peak in January, the USDA projected Brazilian soybean stocks at 11 million mt versus CONAB’s January estimate of 4.4 million mt. The two agency estimates finally converged in June, and have since moved lower in tandem as late season exports have continually exceeded expectations. Most recently, the USDA cut their stocks forecast by 1.5 million mt to 972,000, and CONAB made a 1.8 million mt reduction to 720,000 mt. The increased Brazilian export totals have made a visible dent in the US export shipment pace, with cumulative shipments through last week off some 58 million bu from a year ago.

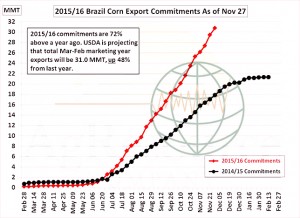

- Brazilian corn exports in November totaled 4.76 million mt, down 1.8 million from October’s record but still well above last year. Year to date Brazilian shipments rest at 18.2 million mt, a full 5 million (38%) above last year, and similarly strong shipment totals are expected into January. In keeping track of weekly corn ship lineups in Brazil, it is notable that the pace of new additions has not changed much as of late November. Total Brazilian corn export commitments as of last week totalled 30.8 million mt, already 99% of the USDA’s annual forecast and up 72% from last year. The slope of the red line continues to point upwards, and we view the USDA’s forecast as some 1-2 million mt too low. The sales pace will be slowing in the weeks ahead, but this year has been an indicator of what Brazil can do with a record crop. Brazilian sales and shipments will be large in 2016 without adverse weather in C and N crop areas next spring, and we maintain that it is competition for global corn exports that will cap rallies, fundamentally. The US has to work (hard) to compete for world share.

- Chicago markets have seen another mixed day with the grains a touch lower and soybeans a touch higher. There remains no evidence of a demand story to add further support prices, in fact, the opposite is probably more realistic.