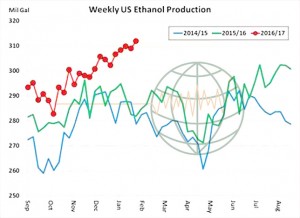

- US ethanol production continues to rise to record levels which is indicated in the chart below. This week’s ethanol production of 312 million gallons sets a new record high. WASDE appears to be running too low in its annual ethanol production estimate by at least 25-50 million gallons, and if this trend persists, it could be too low by 75 million. The US domestic demand for corn remains record large.

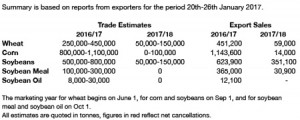

- Weekly US export data has been released as follows:

- Brussels has issued weekly wheat export certificates totalling 816,936 mt, which brings the season total to 16.01 million mt. This is 1.01 million mt (5.93%) behind last year. Barley exports for the week reached 192.559 mt, which brings the season total to 2.72 million mt.

- An uninspiring day in Chicago in what seems like a “rest” in the wake of yesterday’s strong rally where corn spread trade and reports of dryness in the Plains added support. It should not be forgotten that the US farmer has sold most of his old crop soybeans and adds cash corn sales on rallies. However neither the US or S American farmer is showing much desire to make new crop sales at current price levels.

- It seems that the funds will not let go of the reflation trade and see commodities as cheap on price breaks, and it is hard to argue this scenario. It seems almost impossible to get a fund manager to sell sub $3.50 corn or sub $4.15 wheat ahead of the new N Hemisphere growing season. The US has sold 91% of its expected annual US soybean export package with seven months remaining in the crop year. China will return slowly from its week long holiday, and we would probably bet it will be with their buying shoes on starting early next week!