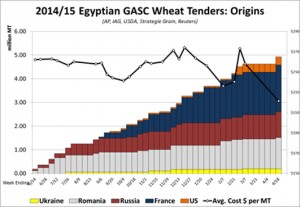

- Over the weekend we saw Egypt return to the wheat tender market for the first time since February 3rd, and they picked up 300,000 mt with 180,000 mt from France and 60,000 mt each from Russia and Romania.

- As can be seen from the graphic above, the price paid was the lowest this season, and surprised many by actually how low it was, the consensus view is that it was below replacement pointing (once again) at the desire to move old crop stocks before the new crop harvest. It may well be that wheat prices are low but crops are looking pretty good everywhere, cash markets have little consumer business on the books, apart maybe from some feed wheat, and if rain continues to fall across the US Plains there will be little incentive for the funds to exit their short positions.

- Staying with wheat, Russia’s IKAR raised their 2015 crop estimate to 54-59 million mt from their previous estimate of 52-57 million mt. With improving FSU and European weather many of the previous pessimists are edging their forecasts ever closer to 60 million mt from the previously sub-50 million mt levels that sent a shiver through many traders. A 60 million mt harvest would likely equate to exports of 25 million mt and possibly as high as 30 million mt.

- Talk today has included further rumblings from Brazilian truckers and there is a suggestion that another strike could develop later in the week. With around 90% of the soybean crop harvested the impact of industrial action is certainly not creating a panic by exporters or processors at this time. In addition cheaper Argentine supplies are offered but Chinese buyers have been active in securing supplies prompting some short covering and higher prices as a consequence.

- It has been reported that despite the above, Chinese buyers have overbought nearby soybeans and are looking to roll April shipments forward, which is likely to cap nearby price rallies somewhat. Out of the estimated 9 million mt that Brazil will export in April, 7 million mt will go to China. With their domestic soybean meal prices in decline the last thing they need right now is record import volumes in April and May. Higher prices may well suit China and help them roll May into Jun-Aug positions.