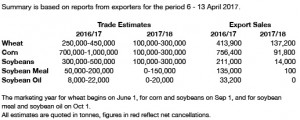

- Weekly US export data has been released as follows

- Weekly EU wheat exports totalled 818,463 mt, which brings the season total to 21.46 million mt. This is 4.54 million mt (17.5%) behind last year. Barley exports for the week reached 85,696 mt, which brings the season total to 4.22 million mt.

- Chicago markets are trading lower after starting in the green, it seems funds are adding to short positions. May options expire tomorrow with traders looking to pin the $3.60 price level in corn, $4.10 level in wheat and $9.50 level in soybeans. We note that July KC wheat is back testing its prior contract low at $4.235 while the low in July Chicago wheat rests at $4.20. Minneapolis wheat is correcting on a slightly drier weather forecast, which has added to the selling pressure on winter wheat futures. US soybean futures are now competitive with Brazilian fob offers for July and August, and new interest is being noted. Brazilian farmers are not increasing sales on the decline in Chicago prices while domestic Chinese soymeal demand is robust. We doubt that fund managers want to push their bearish position too hard right now.

- NOAA’s long term weather forecast for the US called for a warm to hot late spring and summer with above normal temperatures for the much of the Central US. If correct, this could raise some concern for corn which would prefer a cool growing season for trendline or above yields. Other forecasters maintain that there will be a number of weather scares in late spring and summer with heat produced by the warmer than normal Atlantic Ocean. The area of dryness across the SE US is expected to expand. Whether this dryness can work into the Delta and the S Midwest will be closely watched. The W European weather forecast remains dry with limited rains for France, Germany, Spain and N Africa over the next ten days. The soil moisture situation for portions of W Europe is getting serious and will be closely watched in coming weeks.

- Soybean futures are (were) holding, but it is a disappointing day for the grains as KC wheat falls to new lows and corn sinks on improved Midwest planting weather. President Trump mentioned low dairy prices and Canada in a just completed press conference, and there exits potential for a dairy trade dispute. The administration appears to be paying attention to the falling US farm income. Bearish long term price trends prevail.