- We appear to be on the receiving end of another positive day in terms of CBOT markets with all three key products displaying green prices on the screen at the time of writing.

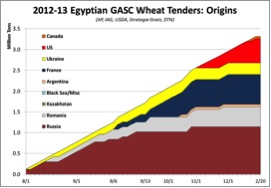

Of note today was Egypt’s 60,000 mt purchase of US soft red wheat for mid-April shipment. There were no French or other EU offers, Australia was also absent, and the one cargo purchased was around $5/mt cheaper than anything else. Clearly the Egyptians can spot a bargain when they see one!

Of note today was Egypt’s 60,000 mt purchase of US soft red wheat for mid-April shipment. There were no French or other EU offers, Australia was also absent, and the one cargo purchased was around $5/mt cheaper than anything else. Clearly the Egyptians can spot a bargain when they see one!

- Whether this purchase has added any real support to the market, or not, remains to be seen in coming days and weeks.

- Soybean complex levels have remained firm as the US continues to see interest from China, as we remarked yesterday, in the light of potential Brazilian supply problems and ongoing positive crush margins. China is rumoured to have purchased 6 to 8 soybean cargoes this week, and it is only Wednesday! We continue to believe that the US S&D is too tight right now to allow continued export business without seeing substantial upward price adjustment to at least ration some tonnage before it is too late.

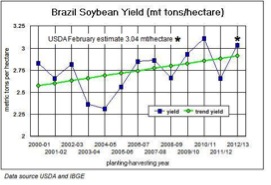

In Brazil we hear that the Mato Grosso dry conditions are hitting yield potential to a significant degree although increased acres are making up for some of the shortfall. The USDA’s projected outturn at 83.5 million mt, issued recently, may well be optimistic given the recent

In Brazil we hear that the Mato Grosso dry conditions are hitting yield potential to a significant degree although increased acres are making up for some of the shortfall. The USDA’s projected outturn at 83.5 million mt, issued recently, may well be optimistic given the recent  weather conditions.

weather conditions.

- Reuters Commodity Research arm, Lanworth, has issued its latest crop forecasts as follows:

US

2013/14 Soybeans 3.465 billion bu

2013/14 Corn 13.7 billion bu

2013/14 Wheat 1.91 billion bu

Argentina

2012/13 Corn 25 million mt

2012/13 Soybeans 49.6 million mt

Brazil

2012/13 Corn 75.8 million mt

2012/13 Soybeans 81 million mt

- Early commentary would suggest that soybeans could well be the favoured US crop given a declining view of corn profitability and a potential switch away from corn on corn acres. Again, time will tell, and the way in which price structures develop in coming weeks will also likely have an impact on planted acres.

- The reduced Argentine output was attributed to hot and dry weather conditions in the early part of this year, and mirrors the view of others. Similarly, the improvement in Brazilian output matches that of other forecasters at this time.