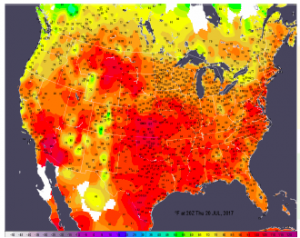

- It’s hot! As predicted by model forecasts last week, high temperature in the 90s have become more widespread, and readings in the low 100s have been too common this week across OK, KS and parts of the N Plains. There is still little moisture relief forecast in the Dakotas into early August, but rain will be badly needed in IA, MO and much of S IL by next week to prevent further erosion in yield potential. There are some hints of ongoing rainfall in the E Corn Belt, but price determination in the very near term will hinge upon any sign of moisture across the W Midwest.

- Soybean futures traded up overnight, and continued on that course throughout the day. Only light producer has been noted and yield and crop size concerns have been cited as the reason for this as the market searches for supply. The close saw 13-14 cent gains, and we are now some 40 cents over last week’s lows. Weather forecasts continue to maintain high temperatures across the Midwest into the weekend with building head scheduled to return next week. The W Midwest and Plains have limited rain forecast and it seems the market is destined to add further weather premium until such time as the weather pattern changes.

- The corn market’s central focus now is projected ten day rainfall in IA and S IL, and today’s updates feature ongoing dryness there into the final days of the month. Only a small pocket of IA benefited from Wednesday’s system. The very latest weather model runs keep meaningful precipitation into next week isolated to far NE IA and N IL, and so the driest areas look to get drier in the near term. This is not a demand led market, until there is more certainty about crop size we view selling breaks as a game for the brave! Yield could fall into the 162 – 168 bushels/acre range, which is very wide and the extreme could prove significant as far as price impact is concerned.

- US wheat futures traded higher on currency news as the US$ hit ten month lows and the €uro made multi year highs, and fund profit taking appears to be towards an end. Australian prices are beginning to recognise lower yield potential and the fact that little rain is forecast into the start of August. Current world prices appear (to us at least) to represent fair value right now, and history shows that seasonal market lows are generally in place by mid-August. Now would therefore not appear the place to become bearish.