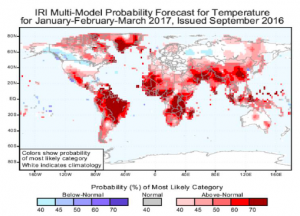

- The latest IRI (International Research Institute for Climate and Society) probabilistic forecast for world temperatures between January and March of 2017 argues for heat invading much of Brazil and portions of Africa. Temperatures have a much better track record of being correctly projected when compared to precipitation, but the model data does argue that there should be a few good weather scares for Brazilian crops during the heart of the growing season.

- It is difficult to find any fundamental reason for a 20 cent gain in soybeans, which has eased back into the close, and the drag along for the grains is similarly hard to explain/justify although the grains have made less significant gains. Further strong gains in Dalian palm oil futures and global vegoils was the catalyst. November soybean futures pushed above technical resistance of 20, 50 and 200 day moving averages, which spurred further buying whilst December corn pushed against recent highs. The CBT Index has rallied sharply with the broader commodity price rally, which is likely to be triggering buying interest.

- There is a question over rains in the W Midwest and parallels being drawn with what happened in Argentina in April, although it is too early to suggest that we may see a similar pattern. However in a market that is looking for a reason to bounce, maybe this is one such reason. The rains are widespread and far less than those in Argentina – watch this space.

- Harvest in the E Midwest and Delta is picking up pace and the yield trend in corn remains variable, and we are informed that it correlates well with where, or where not, fungicide was used. In soybeans yield remains impressive and record large in many cases.

- It is probably best to describe today’s price action in Chicago as “a macro day” with funds adding to length across most commodities. It remains difficult to turn out and out bullish in soybeans and corn with the main US harvest directly in the headlights and with yields potentially improving in corn and at record levels in soybeans. We may well see further fund buying as they tend to follow three day patterns (and this has been day two), but we are reluctant to chase this rally. Big demand is supporting the current price upside and we would be surprised if big yield/output does not cap it before too long. It remains a choppy marketplace.