- We have seen a classic Turnaround Tuesday trade today with ag commodities soaring higher in a countertrend move which has seen the bulls cheering for the first time in a while. Double digit gains have been seen and funds have exited from freshly established shorts in a panic, which added to upward momentum.

- Suggestions that the recent decline has been too far and too fast, and that today is a correction may well be true but today’s rally has been spectacular – and seems to be too much to be ignored for now and needs careful watching.

- It has to be said that there has been no fundamental change to the fundamentals outlook for commodities or the US$, markets cannot go down every day and our inclination is not to chase the rally, maybe this sets up yet more selling opportunities.

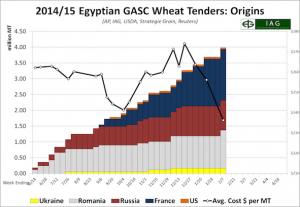

- In more tangible news, Egypt’s GASC tendered for wheat once again, this time for early March shipment. They secured 300,000 mt of, what seems to be, cheap wheat with France winning 120,000 mt and Romania 180,000 mt. The French offer when taking into account twin load ports, moisture allowances and other costs equates to $210 FOB, and compares with feed grade bids at the same level – have the French “choked” on this one?

- Regrettably, wheat farmers are going to see today’s price action and convince themselves that they have been right to hold off selling, and continue with the same course of action. Russian discussions to increase the export tax and intervention price will not change the market, all they will do is add to new crop supplies, where replacement prices are already low!

- In other news Informa Economics raised their forecast for Argentina’s 2014/15 soybean output to 57 million mt, an increase of 1.5 million mt on their previous figure. They also increased their estimate for corn output by 1 million mt to 23 million mt. Interestingly they left their figure for Brazil’s soybean output unchanged at 93.5 million mt. Their corn estimate was raised 550,000 mt to 72.8 million mt.

- All in all, today has been interesting albeit odd, and in the words of one commentator (who we respect hugely), “When the macros, black boxes and algorithms get a hold of the futures markets and move them significantly for little or no apparent reason, remember the words of Benjamin Disraeli (a famous 19th century English fund manager), “Never complain, and never explain”!