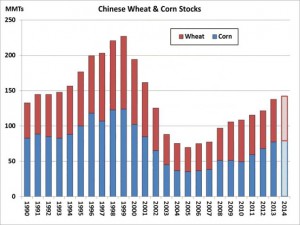

The world grain market needs a demand driver! The world biofuel industry is mature and the recent sharp drop in energy prices will likely limit trade on competitiveness. World feed consumption rates are rising with crop sizes, but it’s unknown if this is a function of residual – or actual – feeding rates. This leaves China as needing to step forward and become a much larger grain importer if there’s to be a change in demand trends – which are only growing 1.8% annually. The chart below reflects that China’s grain stocks are surging – to their highest levels since 2001! China is having to build more storage to accommodate all of the supply. High prices to farmers are stimulating yield and acres. China is not expected to be a sizeable importer in world corn for several years as they chew through their own supply.

Monthly Archives: March 2015

17 March 2015

- Firstly, a happy St Patrick’s Day! The markets may not be patriotically supporting St Patrick as they (Chicago at least) displayed a wall of red rather than the traditional festive green normally associated with the Irish saint! In Europe markets were extremely quiet and it would seem appropriate to assume celebrations were under way but more likely it was down to the reversal of prices in the US.

- In addition to St Patrick’s day we would like to wish Crimea a happy 1st birthday under Russian rule, how time flies!

- Fund selling was active and noted in Chicago as weather forecasts changed for the better (fickle or what?) and long liquidation was the order of the day. US (and world) export demand remained sadly lacking and that has added downward pressure.

- CBOT soybeans broke below their January low, by some way, and confirmed the significance of this by also closing below the level. This points to a test of the late September/early October lows in the fullness of time. May ’15 soybean meal has formed a bearish “head and shoulders” chart patter which should see a test of $295 some $23 below tonight’s close and very close to support formed last September/October (at the same time as soybeans).

- Much is being talked of how poorly wheat is coming out of dormancy in Russia due to lack of pre and post planting rains. It is our considered view at this time that it is too early to make such judgement as it is rainfall in April and May that makes (or breaks) Russian wheat crops. We see no reason for this to be different this year. However, what is clear in wheat is that we are in the early stages of a weather dominated period and with a close to record fund net short position and fears of an extension of the Russian export tax, volatility will probably remain high and price swings potentially violent.

- Corn markets saw around 200,000 mt purchased by S Korea for early October arrival at $193 C&F, which calculates to $167 FOB Brazil. This price makes Ukraine supplies (the recent cheapest global origin) look expensive – AND potentially this price calculates into the US. Are we about to witness the world’s number two exporter selling to the world’s number one exporter in US new crop positions? As prices decline and planting economics move ever closer to favour soybeans could we witness the US as a net importer of corn? (Our comment is made with our tongue firmly in cheek – of course!)

16 March 2015

- CBOT markets were moderate in volume and mixed with corn and soybeans lower with wheat picking up support from what is being described as threatening Plains weather forecasts. Wheat vs. Corn spread trade unwinding has been noted.

- As we reported some weeks back, it was likely that weather would become a significant market driver, and it seems this is now becoming more of an issue both within the US as well as globally. It is probably fair to suggest that the trend in demand for wheat, corn and soybeans from a global perspective is both static as well as stale, and it is supplies that are coming to the forefront of trader’s attention, particularly as we approach the upcoming USDA stocks and seeding report scheduled for release at the end of this month.

- It should also be borne in mind that funds are holding a large (in relative terms) net short position in wheat (63,589 net short) as we head into the new crop norther hemisphere season. Dry conditions in the Plains, parts of the EU and FSU are going to come under even closer scrutiny in coming weeks. Weather forecasters are not promising and relief at this time, which could leave us watching a round of fund short covering and all that goes with it – higher prices!

- The US saw today’s NOPA (National Oilseed Processors Association) report which showed the February soybean crush at 146.97 million bu below estimates of 148.537 million bu and down from 162.675 million bu month on month.

- In Brazil we have seen farmers actively selling freshly harvested soybeans as the Real continues to decline vs. US$. It is suggested that 15 million mt of Brazilian soybeans have been sold in the first half of March, which if correct would be a record volume. The volume of cash sales has been sufficient to fill supply pipelines and looks to be contributing to a weakness in cash export basis prices. Interestingly this year China has been a measured buyer of S American supplies which is certainly capping price rally potential.

13 March 2015

To download our weekly update as a PDF file please click on the link below:

Our weekly fund position charts can be downloaded by clicking on the link below:

12 March 2015

- The USDA has today released its weekly export figures as detailed below:

Wheat: 493,200 mt, which is above estimates of 300,000-450,000 mt.

Corn: 514,300 mt, which is below estimates of 600,000-800,000 mt.

Soybeans: 198,700 mt, which is below estimates of 300,000-500,000 mt.

Soybean Meal: 101,800 mt, which is within estimates of 50,000-200,000 mt.

Soybean Oil: 4,600 mt which is within estimates of zero-15,000 mt.

- Brussels issued weekly wheat export certificates totalling a massive 1,643,824 mt, which brings the season total to 24,254,391 mt. This is 1.788 million mt (7.96%) ahead of last year’s record pace. The volume is the second highest weekly total this season, marginally behind week ending 3 February which saw certificates totalling 1.707 million mt.

- The seasonal switch of international trade away from the US and into S America is evidenced by the drastically reduced US soybean export figures, which were below even the lowest estimated levels. We would expect ongoing US soybean export sales to be minimal for the remainder of the season as Brazil picks up the slack and Argentina, if it ever truly pulls its socks up, to follow as their harvest gets under way. We note from the latest data that one US soybean cargo has been switched to S America, and that there are 656,000 mt of “optional origin” sales outstanding, all of which could be vulnerable to switching purely on economic and financial grounds (S America is cheaper). A rumour is circulating that a US cargo of soybean meal, destined for the EU has been switched to cheaper Brazilian supplies. Like soybeans, outstanding US meal sales include a record large 825,000 to “unknown” destinations and there looks to be a growing possibility that these are vulnerable to switching as well. Any switched volumes will have to be added back to US end stocks, which is why we commented accordingly on the USDA figures earlier in the week.

- In Arkansas, in the US, it has been confirmed that the H5N@ strain of avian bird flu has broken out on a turkey farm. Fears of the virus being spread by migratory birds are growing and a spread into the broiler industry cannot be ruled out as the migration season is under way. The potential for restrictions on exports if there is any spread of the virus should also be borne in mind, and the impact on feed consumption is not minimal given that 14% of turkey and 19% of broiler production is sold overseas. Poultry producer’s margins have been sufficiently buoyant to suggest that early or precautionary culls are unlikely at this time.

- Further suggestions that Brazilian truckers are to resume their blockages have been rumoured although not confirmed. Our contacts advise that any further action is likely to be non-organised, sporadic and with limited impact at this time, but the political protest scheduled for Sunday could possibly re-ignite the issue – watch this space!

11 March 2015

- As is often the case, post USDA report trading has presented something of a conundrum. Yesterdays trade ended with something of a rally and, yes, there was some Chinese short covering in soybeans and meal, but the report held little, if anything, to justify a rally. Even the US$ sharply higher, again, should logically point towards a “sellerish” feel to the markets.

- Perhaps there is a lingering unease over the Brazilian situation with a national day of protest scheduled for the weekend (Sunday), or maybe there is a return of fund monies in the aftermath of recent volatility in US and world equity markets. Regardless, there is little that we can point a finger at with certainty to explain the post report solid feel to the markets. Dollar strength, with 12 year highs being hit this morning and the €uro declining to $1.05 as well as crude oil and gold giving back early gains did little to direct the ags lower. One factor that has maybe triggered short covering in wheat is nervousness over continued dryness.

- Our considered view is that there is nothing fundamental to justify the recent upswing in prices, and that we are seeing a selling opportunity as further price advances appear to have little of substance behind them.

10 March 2015

To download our USDA recap please click on the link below:

9 March 2015

- Today (and likely tomorrow morning) was always going to be about tomorrow’s USDA report, Brazil’s CONAB report and the outcome of discussions between truckers and the Brazilian government. Consequently the vigour of downward price action in recent days has given way to some profit taking and risk-off mentality that has permitted the market to close higher, albeit off the highs of the day.

- In Brazil there has been a further threat of transportation blockages although many believe that this is a measure designed to turn up the heat in advance of negotiations/discussions tomorrow. The Brazilian Real has fallen to 3.1 vs. US$ and we have heard that farmers are upping their selling on the US$ rally. The last week has seen a considerable volume of soybean movement across S America, the advance of the Brazilian harvest doubtless prompting cash selling.

- In wheat we are aware of market concern over dry conditions across the US Plains, EU and parts of Russia. Whether this is justified at this time, given that much of the crop area is still in dormancy, remains to be seen. Suffice to say recent downward price pressure has been enough to allow the bulls a run at this one, any lingering threat of ongoing dry conditions could become an issue, so this is one to watch in coming days and weeks as the crops require an increasing precipitation volume during early vegetative growth stages.

- Stratégie Grains have updated their UK cereals output figures and state that in general winter cereal crops are in “very satisfactory” condition. The mild winter with generally above average temperatures have aided development, they said. It was also noted that spring planting was just getting under way. The UK wheat crop was reduced by 80,000 mt to 15.014 million mt compared with the mid-January estimate, and compares with 16.606 million mt in 2014. Area sown is down a touch and yield was forecast a touch higher although it remains early to be certain on the latter point.

- We expect trade to remain somewhat subdued in advance of the USDA data, scheduled to be released at 4pm UK time tomorrow, and our view is that we are unlikely to see any significant or startlingly bullish data. If this becomes the case we would expect to see a resumption of trend as the week progresses.

6 March 2015

To download our weekly update as a PDF file please click on the link below:

Our weekly fund position charts can be downloaded by clicking on the link below:

6 March 2015

Friday morning musings……

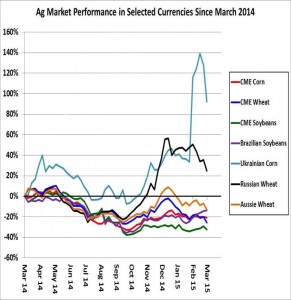

Global currencies remain depressed at multi-year or record lows vs the US dollar. Stated another way, the US dollar posted new 10-year highs this week. As for ag commodity markets in various currencies, Chicago corn, wheat and soybeans have performed the worst. Corn is down 21% from last year; wheat is down 25%; soybeans are down 33%. This year’s decline, as well as lower projected prices in 2015, was cited in the reduction in farm income and acres revealed by the USDA’s 2015 Outlook Conference. Outside the US, the decline in price has been much more subdued – or even reversed. Soybeans in Brazilian reals are down just 14%, which is comparable to $12.50/Bu. Russian wheat is up 25%, comparable to $8.00. Aussie wheat is down 13%, comparable to $5.50. Ukrainian corn is nearly double March of 2014 – comparable to $9.00/Bu. We should be mindful that non-US producers will be more willing sellers relative to their US counterparts amid better local currency values.

This week it was reported that US crude oil stocks are record large for late February – and still growing. The chart below reflects that crude oil bounced off a weekly uptrend line that connects the 1998, 2002 and 2009 lows (long term support?). The break in 2009 was produced by a sharp contraction in US domestic demand, while the bottoms in 1999 and 2002 were on an abundance of supply. There is a possibility that the trend-line could be broken in the next few months with spot oil dropping to test the 2009 lows at $32.50.