- Wheat and soybeans in Chicago are lower this evening and the wheat corn spread, which was at well over $2.00 not so very long ago, is all but a dollar today! How things change and wheat is pacing the decline today reaching five month lows.

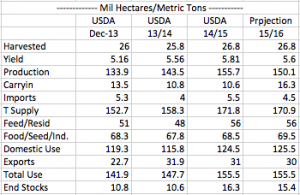

- The USDA has today released its weekly export figures as detailed below:

Wheat: 507,600 mt, which is within estimates of 350,000-550,000 mt.

Corn: 986,800 mt, which is below estimates of 700,000-1,000,000 mt.

Soybeans: 501,200 mt, which is above estimates of 300,000-500,000 mt.

Soybean Meal: 158,600 mt, which is within estimates of 50,000-225,000 mt.

Soybean Oil: 5,600 mt which is within estimates of 5,000-20,000 mt.

There was little, if anything, to raise an eyebrow over in the sales data.

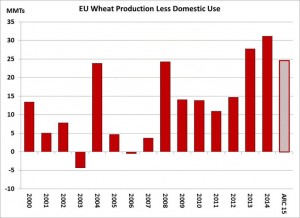

- Brussels issued weekly wheat export certificates totalling 551,358 mt, which brings the season total to 22,610,567 mt. This is 737,869 mt (3.4%) ahead of last year’s record pace.

- Our understanding is that Brazilian farmers have been active cash sellers of soybeans today as the Real crept higher hitting 3.1 vs US$ – talk of ½ to 1 million mt sales are rife.