Weekly CCI Analysis:

The CCI index continued to gain this past week on rising crude oil values along with some support for the livestock sector. The US Central Bank decided to hold its interest rates at historically low levels – but to get rid of the mention of the calendar – and rather determine when US interest rates should be normalized via inflation and US employment data. Our expectation remains that the US will see a rate increase either in September or late 2015. The US economy was sidetracked by weather and the rising US dollar during the 1st quarter, and already there are clear signs of improvement. As the US dollar starts to regain its upward momentum, we look for the CCI to restart a bearish trend with lows not expected until early autumn. Our view is that crude oil either forged a top late in the week or will in the next few weeks. The US dollar should rally on economic improvement while the ags sag on near perfect Central US weather.

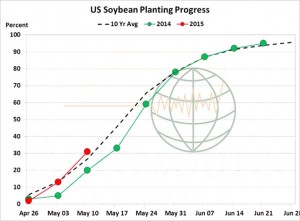

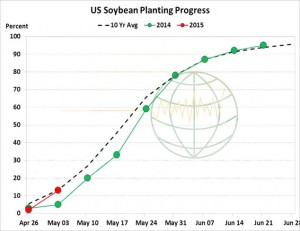

Longer-term soybean analysis:

The soybean market closed slightly lower for the week in a disappointment for the bulls. News of an Argentine transportation strike and US old crop soybean sales to an unknown destination and China sparked a midweek rally. The bearish pull of falling corn and wheat futures could not be overlooked amid favorable US and world weather. US spring crops are being rapidly seeded. As the chart below indicates, US soybean values have been trading sideways for most of the postharvest period. This sideways trade has occurred during a time of rapidly building world supplies and stocks – which has been puzzling. Data shows that China has secured record tonnages of South American beans that are now afloat. This has helped underpin soybeans. The key question is whether China’s demand can continue and will it digest all of the beans that heading their way? Our bet is that China will get a case of supply indigestion and unless US weather turns problematic, that a supply bear trend will resume with a downside price target of $7.50-8.25 November.

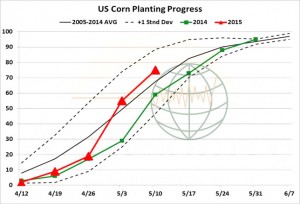

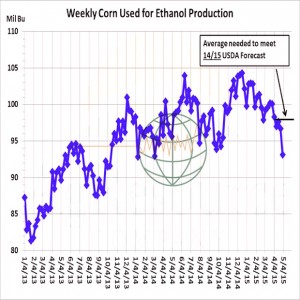

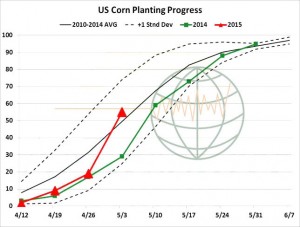

Longer-term corn analysis:

CBOT corn futures lost another 5 cents as the charts turned technically bearish and US farmers strongly advanced their 2015 corn seeding. The Central US weather forecast is nearly perfect for planting and early growth into the second half of May, with a dry and warming pattern to hold until the middle of next week across the S and E Midwest while rain falls in the west. Lingering showers return May 7-10. Unlike last year, El Niño is officially established, which should sustain normal temps and regular rains into summer. New bird flu cases are expanding across the Central US which will trim US feed demand. New crop export business will be awarded to S America and Black Sea amid sharply lower fob offers. Spot corn is nearing our initial downside target at $3.50, which holds until June crop conditions are known. Lasting heat/dryness is needed to keep the Dec ’15 contract from falling to $3.00-3.20 by harvest. Our view remains bearish with pre pollination lows expected by mid June.

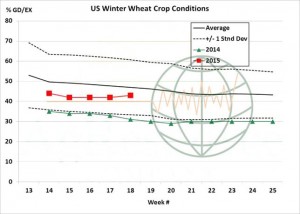

Longer-term wheat analysis:

US and European wheat futures scored new 2015 lows on continued favorable weather and the pending elimination of Russia’s export tariff, which should occur by mid-May. This will affect old crop fob prices more than new crop, but world cash prices for all positions have drifted lower last week. It was another week of improved vegetative index maps across the whole of the Northern Hemisphere, and two-week weather outlooks are rather benign in W Europe, Ukraine, Russia, China and the US Southern and Central Plains. With US winter wheat production to rise 75-100 Mil Bu above last year, better exports are required to ease bulging stocks, and this is the goal of the market in 2015/16. Gulf fob offers are now required to compete with other origins, which in turn implies $4.25-4.50 spot CBOT futures for harvest lows. Seasonal lows may be posted earlier than normal amid Russia’s desire to boost intervention purchases this summer, rather than early autumn.