Weekly CCI Analysis:

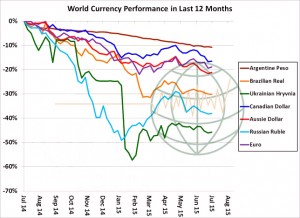

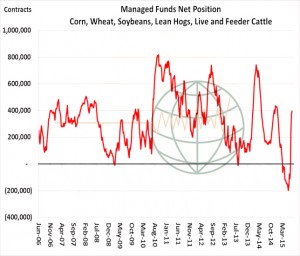

The CCI/CRB index closed lower as the value of the US$ rallied to new multi-month highs. Capital continues to flow into the US which helped push the US stock market to a new historic high. US housing starts were up 10% on July and the US Central Bank is likely to start normalising its interest rates in September. The US economy continues to gain speed while the EU and China are slowing. Chinese economic data remains soft, and our worry is that a deeper economic correction lies in the offing. New Chinese loan demand is not expanding and an over-leveraged economy is likely to correct further. Technically, the CCI/CRB is breaking out to the downside and without a reversal in the week ahead, a test of the March lows is expected. Our view remains bearish with crude oil to test the mid 40’s during the 3rd quarter. A multi-year rally in the value of the US dollar lies ahead with a test of the 2004 highs likely by 2017.

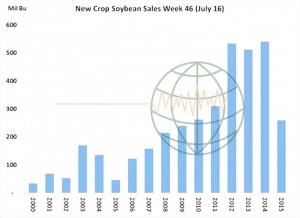

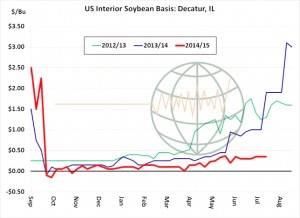

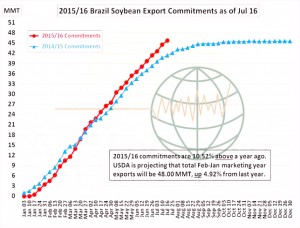

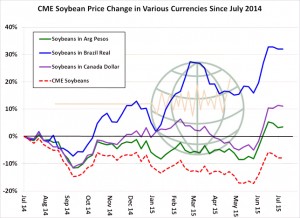

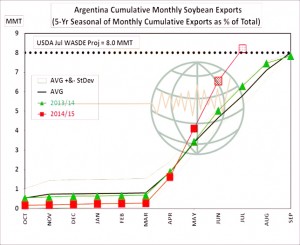

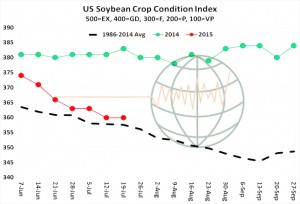

Longer-term soybean analysis:

Soybean futures closed the week lower on improved Central US weather and news that soybean meal was going to be imported into the SE US from Argentina. A seasonal top was likely scored in CBOT soybean futures last Monday evening – unless extreme heat or flooding rains return. US soybean crop conditions are expected to hold steady or improve on Monday. Unlike corn, soybeans are able to produce/utilise their own nitrogen and branch to fill in the barren spots to boost yield potential. Soybeans are a crop of August, and according to some long range forecasts, favourable Midwest weather is expected. Research forecasts a 45.5 bushels/acre US soybean yield and US 2015/16 US soybean end stocks above 400 million bu. What is becoming the biggest problem for the US is that Brazil and Argentina are stealing Sept/Oct and even November soybean export demand to China. Research argues that 2015/16 US soybean exports will be 125-200 million bu lower than the WASDE July forecast. This means that a supply bull market will ultimately become a demand bear once US soybean yield/acreage losses are identified. CBOT soybean and meal rallies look like a sale.

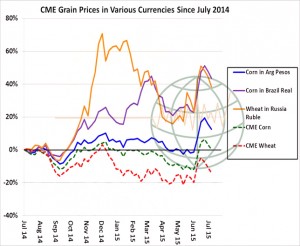

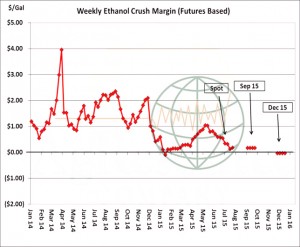

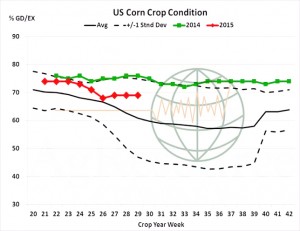

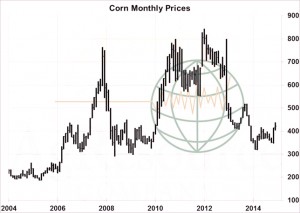

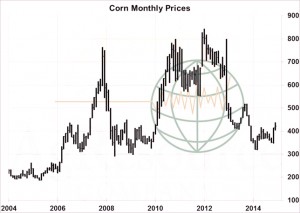

Longer-term corn analysis:

It’s been a week since the July WASDE was released, and Dec corn has found a peak just above $4.50. Corn ended the week 14 cents lower as Central US weather improves; rain has fallen where it’s needed in the Western Corn Belt, while a lasting period of warm dry weather is offered to the East. US corn export demand is lacklustre. It seems reasonable to suggest that without additional flooding precipitation or excessive heat, a seasonal top has been scored. South American fob premiums have fallen to $.25-.43/bu, vs. Gulf premiums of $.60- .70, and ethanol margins beyond Aug/Sep are weak. Yield models maintain a range of 164-167 bushels/acre, which if realised will produce harvest lows of $3.60-3.80. Producers should catch up on 2015 sales on any further test of $4.35-4.40 basis December. There are production issues in Europe, but this extra demand will be awarded to S America. A dramatic improvement in US export demand is required to maintain $4.00+ corn beyond the next few weeks. Corn yields in IA, MN, SD, WI and NE are expected to be record large.

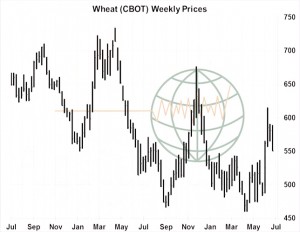

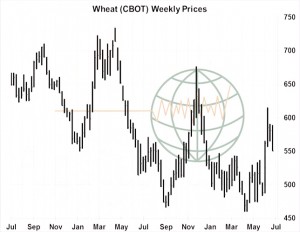

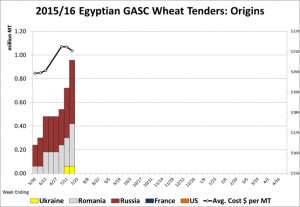

Longer-term wheat analysis:

CBOT wheat ended the week lower, closing at three-week lows. Following NASS’s Stocks & Seeding report, corn has offered support to US wheat but, world wheat cash prices have fallen and the US market is too expensive. Tender results from Egypt and Algeria last week indicate that the going price for EU/Black Sea origin rests at $198-204/mt, which is comparable to $4.90-5.10, basis Sep Chicago. There’s little hope for improved US export demand in the months ahead. Recent heat has not affected European production, normal/above normal rainfall continues across E Australian crop areas, and threats to the global 2015/16 crop are in decline. Even Canadian weather is more favourable into the end of July. To compete for non-traditional business, US futures are required to trade in a range of $4.90-5.40 and there’s been no sign that Black Sea prices will endure any lasting rally with a Russian wheat crop of 57-60 million mt. We are bearish above $5.60 basis September Chicago.