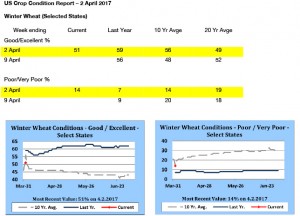

- US winter wheat conditions were released last night as follows:

- Today’s April WASDE report is generally viewed as neutral to bearish for corn, wheat and the soybean complex. Most of today’s changes fell within the range of trade expectations however, further growth in global stocks triggered further weakness in Chicago markets.

- Corn end stocks were left unchanged as a 50 million bu reduction in feed use was offset by an increase in usage for ethanol. Everything else in corn was unchanged.

- US soybean stocks were raised 10 million bu to 445 million as the residual volume was reduced and there were no offsetting changes to either crush or exports.

- US wheat stocks grew 30 million bu as feed and residual use was reduced and more than offset the slight reduction in imports.

- Combined Argentine and Brazilian corn production was lifted by 3 million mt to a record large 132 million, up 36 million mt on last year. S American corn exports were raised 1.5 million mt and global end stocks grew by 2.3 million mt to a record 223 million mt. Importantly global end stocks minus China were also record large at 121 million mt, up 20 million (19%) from 2015/16.

- Global wheat stocks increased yet again to 252 million mt, a 2.3 million increase month on month on the back of increased opening stocks, reduced feed use and trade. Interestingly Black Sea stocks were seen to grow nearly a million mt on reduced exports. There are doubtless still weather issues to come, Argentine harvest conditions, rainfall and soil moisture issues in S and C Brazil in the coming month to six weeks. For now, US and global wheat balance sheets continue to loosen rather than tighten and the pressing necessity to find demand growth in coming months will likely continue to pressure markets.

- It is fair to suggest that S American production is now fully priced into the market at this time and future data revisions will likely be somewhat more marginal. With the NASS stocks and seedlings report and the April WASDE reports now behind us, market focus will shift more to N Hemisphere weather, which will warrant watching for clues as to future price direction.