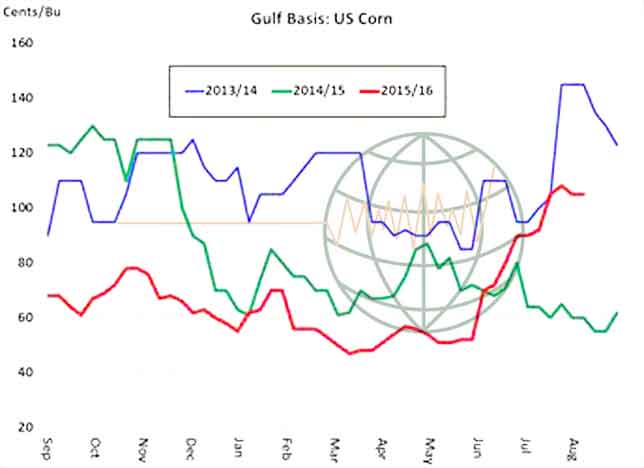

- Gulf cash corn basis levels continue to rise higher based on an active load out program and a slow start to the Delta corn harvest due to excessive rainfall. As Brazilian corn exports are expected to decline by 15-17 million mt (total depends on final Brazilian corn crop size) and Argentina being nearly sold out of its harvest, the US and Ukraine will battle for world feedgrain demand going forward. We expect that with the Russian and EU corn crops in retreat, and the US corn export profile (which is growing by the day) US corn yields will have to rise above 175 bushels/acre for even weaker corn prices during harvest.

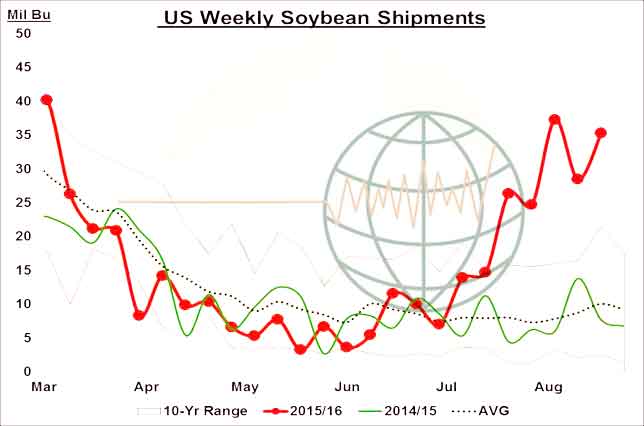

- After the close last night , NASS reported that 72% of the US soybean crop was rated as either good or excellent, unchanged from last week, and up from 63% last year. Including all crop ratings, the US soybean crop is now the second best rated crop on record. Strong export demand continues to underpin November soybeans, with major moving average technical targets at $10.34 and then $10.45.

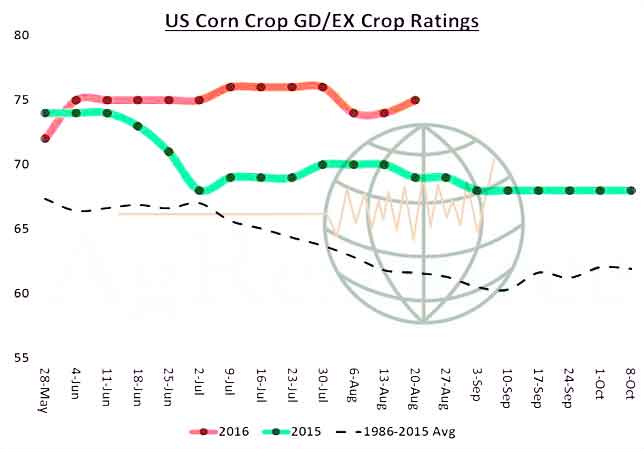

- NASS also reported that 75% of the US corn crop was rated as good or excellent, versus 74% last week and 69% a year ago. The US corn crop is now the best rated crop on record, for late August. The trade will closely monitor the daily updates from the Pro Farmer crop tour. As noted in tonight’s report, Pro Farmer results have proven to be a good indicator of the USDA’s September crop report. This makes sense, since NASS will begin it’s own crop survey at the end of the month. Technical trading and slightly better than expected demand is offering support for the corn market, with initial technical targets at $3.60-3.70.

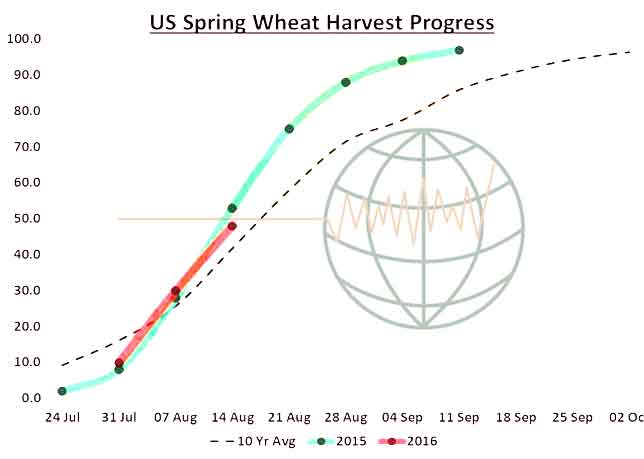

- The Black Sea is where world wheat prices will be determined and talk that Russia is preparing to halt its export duty until next July was seen as slightly bearish. Although the modest duty was not having much impact on Russian wheat exports to date, the trade well understands that Russia has a huge pile of wheat (27-30 million mt) to export, and that the ending of the duty may produce a bump in domestic cash bids to entice farm sales. Russia does not have the storage to hold a record large wheat and corn crop into the winter and a stepped up producer sales program is expected once the summer row crop harvest commences. US spring wheat harvest advanced to 65% complete versus 48% last week and the 5 year average of 46%. A global cash-led rally looks to continue through autumn, but without major N Hemisphere threats next week rallies look as if they will be tough to sustain.