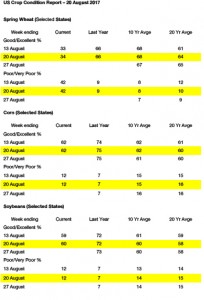

- US crop condition data has been released as follows:

- November soybeans saw an “inside day” of trading for November soybeans, that left the market just below unchanged at the close. The indicator here being possible indecision and lack of follow through, time will tell. The weekly Crop Progress Report showed good/excellent crop ratings declined in 7 states, increased in 7 states, and were unchanged in 4 states. The largest decline for the week was in LA (-4%) and the largest increase was in SD, which increased by 8% to 42% good/excellent, or the best score since mid-June. On a national basis, 60% of the US soybean crop was rated good/excellent vs. 59% last week. 87% of the crop was setting pods vs. the 5 year average of 85%. Producers have limited sales on the books, and last week’s Commitment of Traders report showed that hedgers preferred to use the recent break to re-own the crop. We look for firmer trade this week ahead of the Farm Journal Crop Tour yield results later this week.

- December corn fell another 3 cents on additional rains fell across IA in the last 24 hours, and as fresh demand news is still lacking, something that is typical of mid- August. Crop conditions were unchanged, and the entirety of the market awaits Pro Farmer’s yield result on Thursday evening. The results so far been highly variable (compared to last year’s uniformity). US good/excellent ratings on Sunday were pegged at 62%, unchanged from the prior week and which still suggest a yield no better than 169 in the USDA’s September Report. However, rather than crop conditions, it is now a matter of waiting for combine data, and the Pro Farmer’s tour, as history shows it is a pretty reliable indicator or even waiting on NASS’s September estimate. Crop conditions are unexciting, and concern now rests in the E Corn Belt, where moisture deficits will advance in the next 10 days. Marginal downside risk exits, but amid yield downgrades in the US, Ukraine and S Russia major exporters stocks/use should tighten further in WASDE autumn reports.

- US wheat futures ended modestly lower, as Russian harvest updates suggest yet further upward revisions to crop size. We are somewhat dubious of a Russian crop size of more than 80-81 million mt, but data does suggest the USDA is still too low with its current (record) 77.5 million mt estimate. We also mention that higher estimates will simply spill into end stocks as logistical constraints will cap exports at 30 million mt (or nearly same as last year), but in the near term the markets must contend with the surplus. Spring wheat harvest as of Sunday reached 58%, vs. 51% on average, due of course to a smaller crop and accelerated maturity. Spring wheat futures led Monday’s decline as, along with Kansas futures, funds maintain sizeable net long position in high protein futures. We suspect many of these are passive index fund longs which are counted in managed money due to the manager discretion. Russian fob offers are unchanged at $183-187/mt for autumn delivery. The Russian market is not falling as fast as US futures. The cheapest offer made to Iran in its latest tender are from the US, and while no doubt there’s too much supply chasing too little demand in the near term, the US market is quickly working to find demand. US sales and exports continue to impress. Recall US Gulf wheat in recent years has never been the world’s cheapest in August. Based on Russia, the major exporter balance sheet has loosened in the last 30 days. Like 2016, a bottom should be found soon and a normal post-summer recovery is awaited. The abundance of Russian wheat will just have to be stored into 2018.