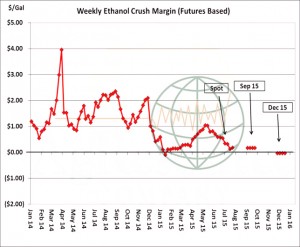

- For the first time since April, crude oil has quietly drifted just below the $50/barrel support level. In addition, broader commodity indexes are retesting multi-week lows. The drop in energy prices is curtailing the incentive to produce biofuels above government mandates, and the graphic below illustrates the recent decline in ethanol production margins – as well as weakening margins in deferred positions. With US corn yield threats in retreat, the goal of market is to maintain near record consumption.

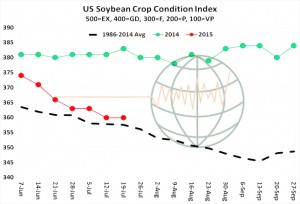

- NASS reported 56% of the soybean crop as blooming with 17% setting pods. National crop ratings for the week stabilised with good/excellent unchanged at 62%. Our index of all ratings was shows the US crop holding above the long term average. Our initial downside target for November rests at $9.50, to be reached later this summer with favourable weather. Longer term our view is that a sharp decline in US export demand through harvest will result in US soybean end stocks in excess of 400 million bu, which could push soybean futures to $9 or below through harvest.

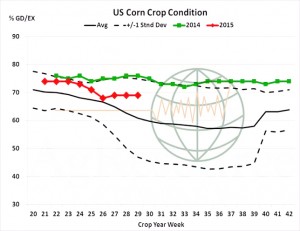

- Corn crop conditions as of Sunday were unchanged from the previous week at 69% good/excellent, which matches the trade’s expectations. Changes of note include 3-5% improvements in KS, ND and OH, and 1-2% downgrades in IL, IN and MO. The yield model, too, is unchanged – yield in NASS’s August report is projected at 165-166 bushels/acre, and the model’s accuracy increase with each passing week. The odds of a sub-160 yield are retreating fast. The crop is 55% silking, vs. the 5-year average at 56%. And our longer term focus remains 2015 export potential. Argentine corn is now offered at just $.20/bu over Dec futures for delivery in October, while US Gulf basis is steadfast at $.70 over. Black Sea feed wheat is also cheaper than US corn. Ethanol margins are negative beyond late summer. A test of $3.95-4.00, basis December, is projected if late July is void of widespread Midwestern heat.

- Egypt’s GASC is seeking wheat supplies for early September arrival, which no doubt will be met with a high volume of Russian and Eastern European origin. US spring wheat conditions as of Sunday were pegged at 70% good/excellent, down 1% from the previous week and unchanged on the year. The decline is largely a function of further deterioration across the PNW, where the crop in WA is rated as just 21% good/excellent. Dakota ratings are unchanged. Note also that the spring crop is 96% headed, vs. 82% a year ago, and harvest progress will be reported in next week’s release. With El Niño so far not having any negative effect on Aussie weather, competition for world export demand will be that much more extreme in 2015/16. We maintain that US fob prices must better compete with other world origins to reach annual export shipments of 900 plus million bu. Russian wheat is offered at a level comparable to $4.90, Sep Chicago. We are accordingly sellers of rallies.