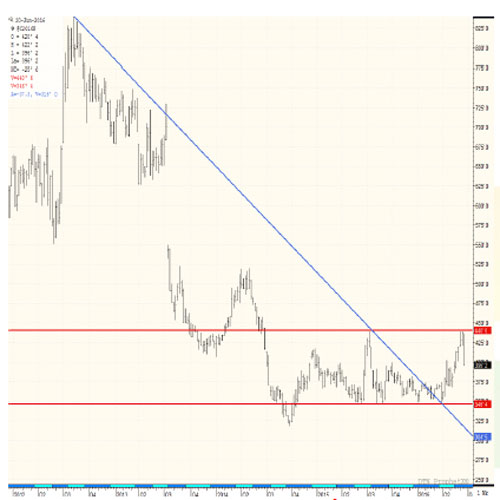

- The chart below reflects that spot Chicago corn futures have held the upper end of a trading range of $4.40/bu (despite the forecast of a 1983 type of Midwest drought by many private forecasters). July Chicago corn rallied on Friday to the $4.40/bu high scored last June and has quickly retreated with futures limit or near limit down today (Tuesday). The sharp corn price drop strongly suggests that a seasonal high has been scored with funds holding a sizeable net long corn position. The next downside price target for spot corn is the $3.50 the lows scored in March. If spot corn futures were able to drop below $3.50, the next downside target is $3.20 – the 2014 low. Of course, if July corn were to take out Friday’s high the next target is the gap at $5.50. Weather, weather and more weather will be the driver!

- Favourable weather forecasts and crop ratings keep soybeans under pressure in Chicago. Prices turned lower in overnight trade and the pace of liquidation quickly increased as the morning opening. Despite some building heat in coming weeks, the crop looks as if it will receive good and welcome rains in the next 5-7 days. Monday’s NASS Crop Progress report expectedly showed a decline in subsoil moisture ratings, and as with crop ratings, a decline in subsoil ratings is typical as the summer progresses. here is relief coming, with drier areas to see good rains later this week. November soybeans closed just above last week’s low, with the next level of support noted at $10.80/bu. China has unsurprisingly showed up as a regular buyer of both old and new crop beans, which should underpin the market on a further correction, and they continue to ready an auction to sell reserve soybeans.

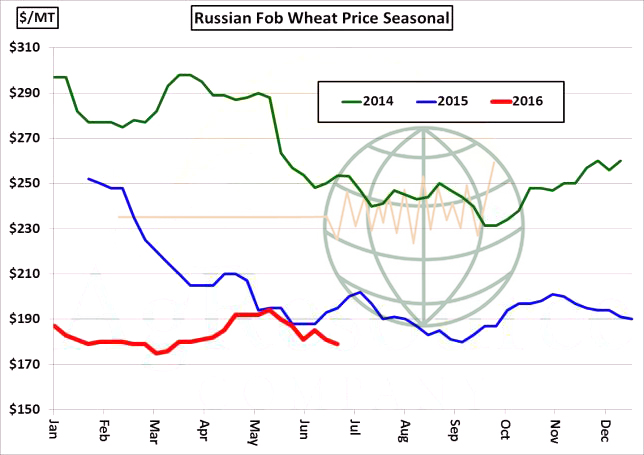

- Corn prices fell sharply as weather forecasts remain non-threatening into July, and the market settled limit down on the cooler and drier conditions. We also focus on demand potential (as we have so often said!), with global feed wheat cash prices trending weaker and still offered at a substantial discount to Gulf corn.As some stage this has to become a price pressure point for corn. Two months ago US Gulf corn was the world’s cheapest feedgrain, offered at a discount of $2/mt to feed wheat and $1-10/mt to S American and Black Sea corn. Today, however, Gulf corn is one of the more expensive grains. Black Sea feed wheat for Aug/Sep is offered $173/mt, vs. Gulf corn at $188. Argentine corn is now quoted $.08-.15/bu below US, and Ukrainian corn is the world’s cheapest corn for Oct and beyond. The window for US corn exports is rapidly closing and buyers are taking note. Fund liquidation was evident, and if current weather forecasts are extended forward we will likely see further substantial liquidation from the recent, close to record, net long positions held by the funds. Technically we believe Chicago and global fob corn prices have forged a seasonal “top”. Some research is suggesting a US yield of 173 bushels/acre, but it remains early days and despite the US corn crop looking good, and withstanding the warm and dry June conditions, we would remind that June weather and final corn yield correlates very poorly!

- Wheat prices hit and/or neared contract lows on the back of weaker corn and weaker global cash markets. Kansas wheat made new lows whilst Chicago (Sep ’16) came within 8 cents of its May low. The markets biggest job right now is to work lower in order to alleviate the burdensomely high US and global stock levels via increased feed offtake, and trend yields and falling corn prices make this more difficult to achieve. EU and Black Sea wheat cash prices fell $1-2/mt, and Russia is still the world’s cheapest origin at $179-180/mt for Aug/Sep. Assuming current Gulf basis, this is equivalent to $4.30, basis Sep Chicago; however, the graphic below (as well as Russia’s expanding crop size) suggests further downside risk exists in global cash markets. We also note that Egypt appears ready to relax its standards on ergot, and so its first new crop tender may be forthcoming. This will be important in determining an actual trend in world prices. We fully expects exporters to be very aggressive!