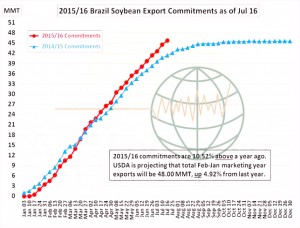

- The graphic below displays cumulative Brazilian soybean export commitments in 2015, as through last Thursday. Brazil’s “local” marketing year begins Feb 1st but vessels start to show up in the lineup in early January. Not surprisingly, commitments this year are well ahead of last year amid a record harvest, but also notice that the pace of new commitments has not slowed. Typically, Brazilian sales plateau in mid/late July, at which point the US takes over. This year, there’s no indication of a slowdown. Brazilian soybean export commitments to date stand at 45.8 million mt, up 10.5% from last year, which compares to the USDA’s projected 5% annual increase in Brazilian exports. In addition to record S American harvests, the willingness of S American farmers to sell is weighing on new crop US demand.

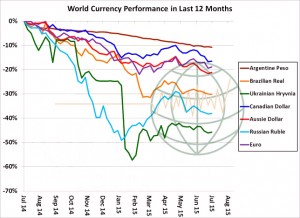

- The US$ has resumed an uptrend, testing multi-week highs, while currencies elsewhere are weaker. Some works suggests that currencies do affect exports to some extent, but have a greater correlation with planted acreage and production. With global commodities priced in US$, weak currencies offer greater revenue and greater incentive to expand seedings. The graphic below displays the percent change in a host of currencies since July of 2014, and all are weaker – some sharply weaker. The value of the Russian ruble has fallen nearly 40% in the last 12 months, the Brazilian real is down 30%, and even the €uro has lost some 20% since last July. Currency will likely remain an issue in the 2015/16 crop year, and major exporting countries will benefit from advantageous fob offers in the world market and greater revenue.

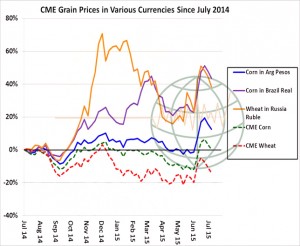

- US grain seedings have drifted steadily lower amid declining net farm income, but our point is this loss of revenue is not uniform across the globe. The strength of the US$ works against the US farmer, but non-US acreage could be steady or expand further in the coming years. Notice in the graphic below, which charts December Chicago corn and wheat over the last 12 years in various currencies, that corn in US$ is unchanged on the year and Chicago wheat is down 14%. However, December Chicago corn price in Argentine pesos is up 13% and corn in Brazilian reais is up 44%. This is comparable to the US farmer facing prices of $5.80. December Chicago wheat priced in Russian rubles is up 40% from last year, which is comparable to $8.80 in the US. A Russian wheat sale to Egypt at $195/mt is revenue of 11,400 rubles; the same sale a year would be revenue of just 7,000 rubles. There’s incentive enough to keep producing and selling outside of the US.

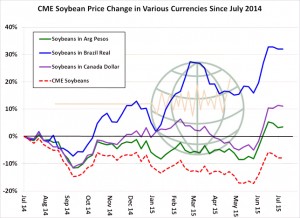

- The soybean analysis is similar, with weakening currencies in Brazil and Argentina – and even Canada – offsetting losses in Chicago. November soybeans priced in US$ is down 8% from a year ago. November soybeans priced in Brazilian reais, however, is just over 30% higher than last year, while November soybeans in Argentina and Canada are up 3-11%. In Brazil, prices are testing the highs of 2014 at 3,250 reais/bu, with planting in S America to begin in mid-September. While US yield is debated, and is no doubt important, it is critical to stay abreast of global production trends and world trade. Our concern is that the US will be further marginalised in the world market amid currency issues, and it is premature to project any widespread decline in global seeded area.

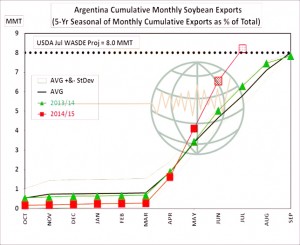

- This morning, US exporters reported the sale of 110,000mt of new-crop soybeans to an “unknown” destination (rumoured to be China). However, cumulative new-crop sales to China are down sharply from recent years. This is because US FOB prices are some $.30-.75/bu above Argentine offers for delivery into autumn. In fact, the USDA’s current projection of Argentine exports for old crop (2014/15) already looks too low. We estimate that cumulative shipments by the end of July will be 8.2 million mt, above the USDA’s projection of 8 million mt. The lineup of ships at Argentine ports suggests that the country could easily export another 1-2 million mt in the August-September period (September marks the end of the USDA’s international soybean marketing year). S American exports are cutting into US new crop demand.

- Yesterday saw Egypt’s GASC secure a further 175,000 mt of wheat for early September shipment, all from Russia in a tender that saw some huge volume offers. Seemingly there was 600,000 mt of Russian wheat on offer, 250,000 mt of which was sub-$193 FOB basis standard 12.5% protein specification, well below replacement. Our take on this is that despite harvest delays and tax issues there is insufficient demand to stimulate a traditional marketplace. French offers were more expensive on an FOB basis that the majority of the C&F Black Sea offers. As an aside, but potentially very relevant, there are concerns in France that whilst yields remain generally very good (potentially same as last year) the protein levels are reducing as the harvest moves north which will leave exporters struggling for export quality volumes.

- Today has seen Black Sea traders licking their wounds after the Egyptian tender; Black Sea wheat FOB prices at just above recent lows suggests (as we have reported) that it is more a demand led than a supply driven marketplace right now as end users fail to queue up to make purchases on the current price break. Russian wheat yields continue to look reasonable but, as with France, there are quality issues being raised as we speak. We would not be at all surprised to see new lows in Black Sea prices before too long – watch tis space!

- The current crop tour in Canada is reporting poor spring wheat yields in SE Alberta and close to record high yields in S Manitoba. Agritel reports the German wheat crop at 24.9 million mt, some 10% down year on year but above the five year average and the Romanian wheat crop at 6.99 million mt down around 6% year on year but above the five year average.