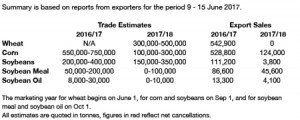

- US export data has been released as follows:

- We have seen continued weakness in Chicago markets today as July ’17 corn futures pushed lower and breached trendline support levels whilst soybeans eased lower on the back of weather conditions best described as non-threatening in the central US regions. Wheat prices also eased on technical selling and a correction from recent rally. Volume today has been somewhat reduced when compared with recent days, and traders appear reluctant to take on fresh risk. It is probably fair to suggest that wheat, at least, has a fundamentally bullish story, but an overbought market and requirement for correction have taken over, at least for now.

- Egypt’s GASC have secured a further 175,000 mt of wheat from Ukraine and Romania, perhaps unsurprisingly. The ongoing ergot issue continues to leave traders wondering what is happening in coming weeks in Cairo.

- The Argentine Peso is sitting just below a record low level, which is potentially keeping pressure on fob prices for corn and soybeans . Corn at 2 cents over Chicago prices is a record low level and points to the large exportable surplus as well as the currency incentives available to exporters.

- Hot and dry conditions are starting to adversely impact Ukraines’s corn crop and exportable surplus. The USDA has forecast exports of 20.5 million mt from a crop of 28.5 million mt, and many now peg that crop at 26 million, leaving export availability some 2 million mt lower. Ukraine weather is looking even warmer next week.

- Markets are targetting chart support levels in the absence of continued weather threats. The only bullish story surviving right now is that of hard wheat supplies being downgraded due to earlier weather difficulties, soybean yield judgement is still too early in the season.