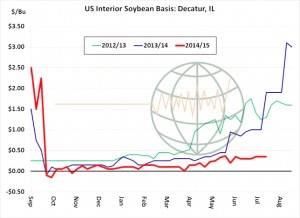

- Unlike the past few years, US Central IL soybean cash basis bids have not exploded to the upside on the more abundant old crop supplies. Midwest cash soybean bids have firmed modestly since May, but there is no squeeze for supply, and as the harvest will start across the Gulf States in August, the pipeline for US soybeans is adequate. We expect that cash soybean basis will weaken during August and early September on slowing crush/export demand and the arrival of the Midwest harvest.

- Our outlook for US soybean yield based upon weather predictions for the next three weeks, bearing in mind that soybeans are “a crop of August”, is for trend or better, and we are optimistic that 46 bushels/acre could well be the bottom end of expectations. However, the bulls want to take US acres down, they won’t accept that trend yield remains possible, and they want to run with the USDA’s demand base, despite the current pitiful pace of export sales and the lack of last year’s need to refill the pipeline (end stocks of 255 million bu against 92 million bu). And whilst it’s still a long way off, there is already talk of a 100 million mt crop in Brazil next year, and 60 plus million mt in Argentina given the move away from wheat and corn crops – none of which is bullish US for exports. So whilst the market still needs to pin down the supply side, the focus will switch to demand in a few weeks.

- In corn, the US yield debate goes on but it appears clear that the crop’s potential is improving, and today’s export sales look as if they confirm that at current prices, the USDA is way too high on its export number.

- Black Sea wheat is getting back towards the early summer lows but the Ruble has lost 8% in the meantime, which has more than protected the interior price, and there is still little sign of the declines bringing out any real consumptive interest. US funds are getting close to square and the charts are starting to look oversold, but US fundamentals remain poor and the market will watch for funds shifting to a net short position.

- The USDA has today released its weekly export figures as detailed below:

Wheat: 502,800 mt, which is above estimates of 200,000-400,000 mt.

Corn: 534,800 mt, which is below estimates of 555,000-950,000 mt.

Soybeans: 322,600 mt, which is within estimates of 300,000-700,000 mt.

Soybean Meal: 33,700 mt, which is below estimates of 75,000-250,000 mt.

Soybean Oil: 18,100 mt, which is above estimates of zero-15,000 mt.

- Brussels has issued weekly wheat export certificates amounting to 431,148 mt, which brings the season total to 1,315,696 mt. The season to date total is 745,454 mt ahead of last year.

- The Chicago soybean complex has led the market lower since midday whilst the grains have proved somewhat more resilient displaying unchanged to slightly lower prices with just over an hour to go. The morning break was all about demand, not weather as some have suggested. Taiwan and S Korea have both booked corn from Brazil at prices well below US Gulf, and US new crop soybean sales continue to run at around 50% of last year’s pace, which currently suggests a run rate some 200 million bu below the USDA’s latest WASDE numbers. First half July Russian wheat exports are at their lowest level in ten years (blame export tax issues) and with a reported two Argentine soybean meal cargoes en route to Europe, without a home, and we can begin to understand why the demand side of the S&D equation has many worrying. Our understanding is that US soybean meal exporters discounted prices (heavily) in a tender to the Philippines – and missed it! Little wonder US prices are in retreat, with more to go if export volumes are to pick up.

- Finally, the midday Central US weather forecast calls for showers and storms across the N Plains and the NW and N Midwest which would be ideal. Some areas of IA and SW MN are in need of rain. A few light showers will bleed into S IL and IN to keep soil moisture adequate. Any heat will be centred on the S Plains and the SW Midwest with highs in the lower 90’s. Generally favourable weather is offered across the Midwest for the next few weeks.