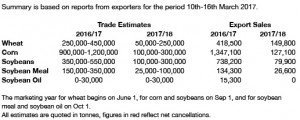

- US weekly export data has been released as follows:

- Brussels has issued weekly wheat export certificates totalling 235,077 mt, which brings the season total to 18.8 million mt. This is 2.6 million mt (12.3%) behind last year. Barley exports for the week reached 81,641 mt, which brings the season total to 3.7 million mt.

- It has been another lower day in Chicago markets with even better than estimated US weekly exports (see above) unable to stimulate fund buying or short covering. Crude oil is a shade lower amid growing US stock levels.

- Generally, global weather forecasts remain favourable to crop planting, development and/or harvest, depending upon location and we would not anticipate any major surprise or upset in next week’s stocks/seedings report.

- This week’s US Drought Monitor showed expansion in abnormal dryness across TX, KS, OK and pockets of the Delta/Southeast. 36% of the country is experiencing some kind of drought, vs. 32% a week ago and 35% a year ago. As such, the coming Central US pattern shift is needed, and we would fully expect drought or drought risk to shrink in the next two weeks. Climate work also continues to point towards an active pattern of moisture through the first half of April. Some planting delays are inevitable, but it would be wrong to suggest that an improved soil moisture profile is both desired and necessary.

- It is interesting that markets have continue to ease lower amid positive demand news, and this should not be overlooked. The trade appears to be focusing on next week’s stocks and seedings data and weather instead, and indeed the abundance of DDGs and other feed alternatives could force yet another lower revision to US corn/feed residual use, which is often the focal point of quarterly stocks report.