- Our early morning commentary included the following:

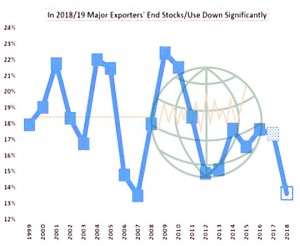

- “World wheat traders are starting to focus on drier than normal weather conditions across Canada, Australia, and the Black Sea. And, we now fear that Plains heat could further trim the US HRW wheat crop. The reason why traders are so acutely focusing on weather in these wheat export areas, is that using WASDE May Crop production and demand estimates for 2018/19, produces a sharp drop in the major world exporter stock/use ratio. This ratio has fallen to its lowest level in 11 years and any further crop decline could cause a demand a price rationing rally.”

- This was followed by weaker tones in soy and grain futures on Tuesday afternoon’s contrary comments from President Trump announcement that there is; “No deal with China’s ZTE and that I’m not satisfied with the US/China trade talks.” The White House emotion on China/South Korea and US/China trade should not be unexpected as the US postures ahead of additional trade meetings with China and the coming US/South Korean Summit in Singapore on June 12. President Trump is trying to lower everyone’s expectations, but we doubt that much has changed since Saturday’s joint US/China announcement on a breakthrough framework for future US/China trade negotiations. White House staffers and other DC sources confirm that Trump’s comments are focused on “expectations and the uncertainty negotiating with N Korea. If there was real concern, Chicago soybean futures would be more than 2 cents lower. However, China crushers and importers are still slow to return to the US soybean marketplace following the weekend trade announcements as their domestic soy markets are still well supplied and they are long a considerable amount of Brazilian fob premium that has imploded in the past two weeks.

- As the day progressed It has been a mostly green morning in Chicago with corn, soybeans and wheat all higher. Rumours continue to spread as to what China might be willing to secure under President Trump’s promise that China secure an additional 35% of US agricultural goods (weekend US/China trade framework agreement). US commodity groups continue to work hard to elevate their own interest as US Commerce head Ross prepares to head to China following the Memorial Day holiday. Chicago has a firm tone at midday and we are expecting a higher close. The market feels like new demand is occurring. We have been told that China’s SinoGrain has booked US soybeans off the PNW, and is asking for additional offers. Some speculate that SinoGrain is rotating their soybeans from their reserve (replacing them with US purchases). However, its far more economic to replace reserve beans with Brazilian (not the US), so cash traders are talking that some sort of early pact has been cut with the US to take their soybeans to further build their reserves. Tonnages speculated on vary broadly, but the key is that China has returned to the US market as a soybean buyer. This follows news yesterday of CIQ allowing US boats to unload.

- There is a debate emerging that the US may have asked China to follow and adhere to their WTO 2001 promises. Back when China became a WTO member they pledged to import 7.2 million mt of corn, more than 9 million mt of wheat, 5 million mt of rice, and over 900,000 mt of cotton. China would then issue the TRQ’s to state run firms or in such small parcels that they never were fulfilled. Could the US be willing to push a like framework (China has already agreed to WTO and US is calling them out for nonperformance) for US products to diminish its trade deficit. Our point is that we anticipate the discussion over what US ag products might China import to expand well beyond soybeans in coming days/weeks.

- The midday GFS N American Weather pattern forecast remains too wet with better rain potential for the northern half of the Plains (than what was advertised by the EU model) overnight. The Midwest will see normal rains with above normal temperatures, which allows summer crops to flourish. High temperatures will reach into the 90’s to lower 100’s across the Plains with mid 80’s to mid-90’s across the W Midwest. Such warmth this early in the growing season is unusual, but shows no correlation to a budding drought. This remains a complex N American weather pattern, the GFS is struggling with rain amounts, but, flooding rains are slated to drop across the Gulf States amid a tropical system. Some areas will endure 6-9” of rain in the next 5 days.

- The Black Sea forecast remains arid across the east (and Ukraine) with cool/wet weather for their western spring wheat areas for another two weeks. Crop losses are mounting. However, it will be key if July KC wheat can close above the 2017 high at $5.5675. Soybeans are rising on renewed Chinese demand amid rumors that China may be prepared to rebuild its reserves through US soy imports. July soybeans are holding the 50-day moving average. A close above $4.085 basis July corn futures sets a target of $4.15-4.20.