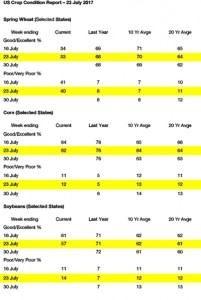

- US crop condition ratings have been released as follows:

- Soybeans were down overnight on weather related selling on the rain across parts of the Midwest. Yet, the afternoon close was more than 10 cents over the overnight lows. After the close, NASS reported national good/excellent crop ratings were at 57% versus 61% the previous week. Excluding the 2012 drought, good/excellent ratings for this week are now the lowest since 2006!.The big surprise was an 8% drop in IL good/excellent rating to 59%. OH slipped 3%, IN was down 2%, and IA was off 1% from last week. In the Plains, ND good/excellent was up 1%, while NE and SD each lost another 4% on the widening drought. National good/excellent crop ratings were well under expectations, and will support a higher soybean trade overnight. November soybeans have held a broad range of $9.85-10.45 in the last three weeks, and we look for this range to hold into the August crop report. US soybean yield potential is quickly rolling backwards.

- Corn futures ended lower, but well off session lows, as the Central US forecast lacks any meaningful rainfall beyond the next 72 hours, and nearby totals will be confined to parts of SD, E IA, MN and WI. Crop conditions continue to erode, and as we have mentioned previously we struggle to peg national US corn yield above 165 bushels/acre. Weather premium will be added on Tuesday. good/excellent ratings as of Sunday totalled 62%, down 2% from the previous week and compared to 76% on this week in 2016, or a 20% decline in ratings from last year. Note that conditions deteriorated in IA, NE, ND and SD despite recent rainfall there. Another slight decline is anticipated next week. Brazilian farmers are reported to no longer be profitable, and it will be interesting to see how first-crop corn acres change there, with planting to begin in September. A 159-162 bushels/acre US yield cannot be ruled out until a wetter pattern change is confirmed, which looks increasingly unlikely.

- Wheat futures followed corn to moderate losses, and as yields reported from Russia and Ukraine have improved relative to last week. Russian wheat production may be a record 74-75 million mt, but the sum of major exporter production is trending lower amid ongoing dryness in Canada and Australia, which in the case of Canada will most likely get much worse into the first part of August. Spring wheat crop ratings continue to decline, albeit slightly, with current good/excellent (33%) a record low for this particular week. World cash prices are weaker following lower futures in the US and Europe, and as the €uro and Ruble weakened slightly. Weather, however, is little changed and very heavy rain will be ongoing in Germany and Poland in the next 2-3 days. Cumulative totals are put at 3-4” there. Canada will be warm and very dry, as a broad Ridge/Trough pattern continues across N America. Recently added long positions are being liquidated, but work suggest fair value lies between $5.00-5.50, basis spot Chicago.