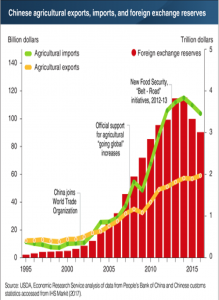

- As you can imagine, we have been spending considerable time attempting to understand the issues of trade between the world’s two largest economies, the US and China. The graphic below reflects key political occurrences between China and the world such as 1) China’s joining the WTO in 2001, 2) China’s official support of ag producers of their “Going Global Policy” in 2007, and the latest, 3) The 2013 Belt Road Security Initiative. These three programmes have had broad ramifications for world agriculture. However, as China prepares for 300-350 million people to enter the middle class in the next decade, there are real concerns within China as to their ability to continue self-security in food/fiber (beyond soybeans). This may be the reason why China is prepared to allow greater US ag imports to help balance the trade dispute.

- US weather forecast maintains heat into June with some wetness in N Plains. A high pressure Ridge aloft the Plains and Southern US will be briefly interrupted by a tropical storm this weekend. However, a warm and modestly dry outlook remains intact. Potential record breaking heat lies ahead this weekend. Highs in the low/mid-90s will be widespread across the Central US. High readings at 100-104 are probable across the S Plains during the opening days of June. This week’s Drought Monitor features improvement in TX, OK and KS, but exceptional drought remains across the far W Plains. Soil moisture loss in the next ten days will be substantial. Meaningful rains will be isolated to the Delta/Southeast early next week as a tropical storm Alberto makes its way across the Gulf. Regionally heavy rain also impacts the N Plains and Upper Midwest next Wednesday to Thursday. We are confident about the return of heat in June.

- Elsewhere, precipitation into June 1 will be limited to light/scattered events. Steep declines in soil moisture lie in the offing amid abnormal warmth. The 11-15 day forecast offers better rain chances to areas most in need of moisture, including MO, IL and IN, as high pressure ridging retreats south and west. However, confidence so far out is low, and the GFS forecast has been lacking in accuracy in recent weeks. We would caution against expecting an outright pattern change into the middle part of June. So far there is no major crop stress aside from heading Plains winter wheat. Coming heat will accelerate summer row crop growth, and likely boost vegetation health ratings. However, when such strong high pressure Ridging has appeared in May, it is noteworthy. Below normal soil moisture across the Plains and W Midwest elevates the risk of heat and dryness in early summer. The overall pattern has to be closely monitored.

- It was a mixed day of trade in the Chicago soy markets. An early rally in soybeans had July testing $10.50 while November stopped just short of contract highs. However, news that the US/North Korea Summit would not be occurring produced profit taking. The weekly export sales report showed net soybean cancellations, which was expected following Friday’s large daily cancellation announcement. In soybean meal, weekly exports slipped to a seven week low while sales were near average. Note that while meal exports have inched lower in recent weeks, the pace is record large through May. Also, cumulative exports are 11% over last year. The USDA could raise their meal export forecast again in the June WASDE. Aside from the weekly export report, other news was minimal. The Brazilian truckers strike looks to be expanding, while Argentine harvest was estimated at 80% complete. Ahead of the long weekend, we expect a pensive trade as trader’s take stock of Central US heat and returning Chinese demand for US soybeans. Argentina will be closely monitored to see of the Government holds fast to export taxes on soy and returns a 10% tax back on grain exports.

- Corn futures fell 4 cents on the US/North Korea Summit cancelation, and that President Trump will take a harsher stance on trade. We estimates that managed funds as net long 215,000 contracts of corn, vs. 192,000 last Tuesday, and which is somewhat sizeable for late May. Amid such length, choppy trade can be expected. However, world weather patterns are far from ideal. US export sales through May 17 totaled 34 million bu, down 5 million from the prior week. However, with 15 weeks left in the 2017/18 year, exporters must average only 8 million to hit the USDA’s target, which increasingly looks 25-50 million bu too low. The EU and GFS weather models are at odds on even near term US weather. We lean towards the better performing EU model, which keeps precipitation into June 1 strictly confined to the Dakotas and Southeast. Steep declines in soil moisture continue in Brazil, Russia and Ukraine. It will not take much weather adversity to push corn futures to new highs. Traders note that record heat that is likely across the Plains over the long holiday weekend. Chicago corn will not sustain a break until a new record large US yield is confirmed. Ukraine dryness has to be closely watched.

- Chicago wheat futures ended little changed in a session generally marked by weaker raw materials as a whole. US wheat export demand was lackluster, but it is Black Sea weather that will determine future price direction on return from the Memorial Day holiday. Contacts in Russia have started to lower yield/production estimates as dryness takes a noticeable toll on winter wheat, while spring wheat is just 50% planted on ongoing cold/wet weather. US new crop export commitments through the week ending May 17 rest at 88 million bu, down 30% from the same week a year ago. The US market is not in a position to boost its share of world trade amid HRW premiums of $27-44/mt ($.70- 1.20/bu) over Russian and German origins. However, whether world cash prices sit or rally significantly will hinge upon June weather patterns in the US, Black Sea and Canada, which currently do not look very promising. Adverse weather also will force the market to demand steep wheat premiums to corn. Support rests at $5.30 basis July Chicago. June weather is critical.