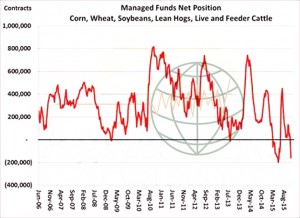

- By our calculation the funds nest short position, updated to last night (and it can not be totally accurate) suggests that they are back at, or close to, last June’s 200,000 net short position. Such a large position, as we head into the crucial S American growing season is a recipe for volatility. Any adverse conditions that develop in December of January would doubtless encourage a sharp short-covering rally. There is no suggestion right now that this would happen, however we would express surprise if we did not see at least one weather scare in the run up to late January’s harvest. We continue to advise a cautionary approach.

- Last night’s close in Chicago saw a price “key reversal” is soybeans, which is often associated with the formation of a bottoming pattern. Both soybeans and meal made fresh contract lows before short covering saw prices close higher.

- Today has seen Chicago grains easier with soybeans just in positive territory as we approach the close. The weekly price chart in soybeans is also displaying a reversal pattern, which appears to be gaining the interest of funds, particularly as we see crude oil, gold and CRB Index all bouncing off recent lows. More optimistic global economic growth and inflation outlooks are also prompting a “bottom picking” mentality, and we all know the old trader’s joke about “bottom picking” etc. etc! The grains are easier on lack of fund follow through although any soybean strength could possibly spill over into grains.

- Black Sea and EU fob wheat prices showed continued weakness on lacking demand and Jordan has for the second time in two weeks cancelled a 100,000 mt wheat tender.

- The downing of the Russian jet by the Turks overnight has fueled widespread speculation as to what will be response from the Russians. Russia and Turkey have battled for decades, so this skirmish is not something new. However, Russia does provide 57% of Turkey’s natural gas supply and if it is shut down prior to winter this would severely impact Turkey’s economy. Moreover, Turkey is Russia’s 2nd largest wheat importer and there is talk of a partial embargo. It seems as if everyone is trying to gauge the Russian response to Turkey’s military downing.

- Finally, one has to remember that most Black Sea trade moves through the Bosporus Straits (ag, energy and even military) at Istanbul so this shipping lane is vital. The Bosporus Strait is hugely important from an ag logistical standpoint and any slowing/blockage is something being discussed by importers and end users this morning.

- Clearly there are some geo-political issues emerging, and these will bear watching.