Weekly CCI Analysis:

The CCI Index has been consolidating in a rather narrow range for the past 6 weeks. News that China had cut its banking reserve ratio and that the US Fed was unlikely to raise interest rates in September could not sustain a recovery. Gold, grains and tropical markets declined. The week’s bullish stalwart was crude oil as it powered to its highest price since November. Research signals that above $60.00 new money will be poured into fracking wells and that those wells that were mothballed due to lack of profitability will come back on line. We doubt that crude can sustain a recovery and would favour selling late summer crude oil contracts near or above $60.00. Further research calls for a top in the CCI index in early May with a seasonal decline into late summer.

Longer-term soybean analysis:

The soybean market traded moderately higher through most of the week with support offered from fund short covering. No changes for the US supply/demand outlook were offered, but the market was focused on the threat of a Brazilian trucker strike and the potential impact on Brazil’s export ability. The strike was ultimately a non-event with regard to world export flows and soybean futures eased back to unchanged or lower by Friday’s close. Market focus going forward will be on US planting progress and the extended weather forecasts. The forecast into early May is supportive for timely plantings through the Delta and Midwest. Our market outlook remains bearish with a view that November soybeans could fall to $7.50-8 at harvest given a normal growing season. Our initial target for July rests at $9.00 and then $8.50.

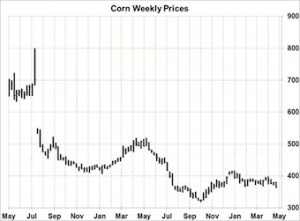

Longer-term corn analysis:

CBOT corn fell 15 cents this week as the market’s confidence on a warmer and drier Central US pattern beyond early next week is rising. July corn has fallen below key support at $3.75, with next meaningful support targeted at $3.50. Fresh news continues to be bearish. In additional to technical weakness, a lasting period of warm/dry weather is scheduled for April 28-May 5, during which a majority of the US crop will be seeded. NOAA’s (The National Oceanic and Atmospheric Administration) outlook for the month of May features near normal temps and precipitation. Of course El Niño has been is established, which in recent decades has been highly favourable for N Hemisphere grain yields. A weather story is lacking. Longer term, with another large non-US surplus probable, the US market will have to buy back world trade via cash prices. The Dec ’15 contract holds some $.50-.80 of weather premium, which will erode slowly with a major US weather pattern shift in June/July. A “sell the rally” mentality will persist without adverse weather.

Longer-term wheat analysis:

US wheat futures ended mixed. CBOT contracts fell 8 cents and are testing Feb’s lows; KC wheat fell 5 cents on the recent boost in Plains soil moisture, with additional light showers projected across KS and OK into early May. Spring wheat ended steady amid ongoing dryness across ND and MN. Our outlook remains unchanged, and rallies in the coming weeks offer selling opportunities. Winter wheat crop improvement is noted across the whole of the Northern Hemisphere, and with El Niño to build into summer we doubt that lasting heat or dryness will develop. Black Sea exporters will be even more aggressive as and when the export tariff in Russia is lifted, and the dominant theme of the markets is that US wheat remains completely uncompetitive. Lows in world FOB markets this summer are projected at $165-175/MT, and $4.25-4.50 CBOT wheat is needed to compete globally. Russia may have a record exportable surplus this year at over 25-28 MMTs.