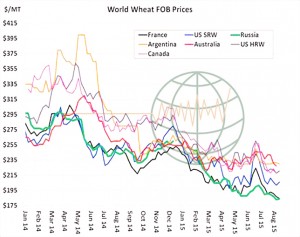

- Russian and French fob wheat prices continue to pace the decline. Both markets have eased to new lows in recent days as evidenced by the chart below. Notice that US wheat remains noncompetitive and that export sales are likely to remain tepid into autumn. Australia is expected to become a more aggressive exporter on currency and supply with a few more rains. US wheat futures are trying to rally, but are unable to carry through amid sagging world wheat values that are looking for fresh demand.

- General market comments:

- The value of the US$ has been directing Chicago grain prices this week amid a lack of other fresh fundamental news or information. EU wheat yields continue to be better than expected which will help the community deal with its corn shortage.

- While the soybean market remains oversold, traders see the good weather of the past week as a reason to suspect better production while global currency developments spark weaker demand concerns.

- In corn, the weak technical picture opens the door for a test of Monday’s lows and perhaps a test of the August 12th lows.

- In wheat the market action is bearish as even the technical correction off of the lows Monday showed a lack of commitment from the bulls. Fundamentals are weak and shallow corrections may continue until the bulls have something more than “oversold” as a reason to buy.

- Despite something of a recovery in global financial markets the Chicago grain room has found selling pressure as world cash markets in wheat, corn and soybeans all ease lower. Tunisia was a wheat buyer today, cheaply, and this has had traders pondering quite how poor global demand truly is right now, and this includes China who are still not pitching in for US soybeans. Ongoing cash market weakness is undoubtedly pressuring futures prices in a spate of fresh export business.

- The weak Brazilian Real (3.6:1 vs. US$) is not helping Chicago markets either. The weak Real is down to political as well as economic drivers with growing numbers calling for the impeachment of President Dilma on account of her knowledge of “backhanders” from Petrobas. As we have stated previously, the weak Real, Ruble and other emerging nation currencies reduces the purchasing power of the consumer but at the same time stimulates agricultural production within each of the nations. This creates a longer term bearish paradox for the now long suffering (???) US farmer.

- China imported record tonnages of grain during July with combined wheat, corn, barley, DDG and rice imports at over 4 million mt. The rising imports are about to collide with another sizeable Chinese grain harvest that will start in September. Amid China’s growing stocks of grain (highest level since China entered the WTO in 2001), the Government continues to look for ways to slow imports through regulation. US DDG and sorghum cash basis has declined in recent days amid concern about a slower Chinese grain import profile this autumn.

- CBOT grain futures will continue to follow macro market developments and how the Chinese equity market reacts to their monetary easing stance overnight. Any actual or perceived weakness in the Chinese equity markets will not bode well for commodity valuations. All eyes will remain on China amid the fear that their economic slowdown is worse than being reported by Beijing.

- It is expected that the Chicago market will hold at $8.50 November soybeans, $3.60 December corn and $4.80 September wheat heading into the Labor Day weekend (5-7 September). However, we remain extremely concerned about the lackluster world grain demand and that EU, Russian and Canadian crops continue to get larger. Even Aussie wheat looks to be all of 25 million mt amid the recent rains across NSW. Aussie fob wheat prices have fallen $20/mt in the past few days as the market shifts from old to new crop bids. The Aussie wheat harvest will start across Queensland in October. Our generally bearish view is maintained, but we would be reluctant (or cautious) to make sales here and anticipate some sort of recovery into early September.